Having a financial understanding is critical at all ages, but should we prioritize financial literacy for middle school students? After all, proper money management and responsible financial decision making are important life skills. However, many of today’s students don’t have the financial literacy they need to navigate and succeed financially in the modern world. Often, financial education is a priority for students entering the job market in high school, but it’s important to reach students before they’re making key financial decisions. We can set financial foundations in middle school and earlier.

Setting the Foundation Sooner: Financial Literacy for Middle School Students

It’s often assumed that high school financial education curriculum will be enough to fulfill students’ financial education needs. That’s what we all want long-term – for teens to graduate high school and enter the real world with a basic understanding of financial literacy skills. The reality is only 42 percent of states require high school financial education, and even fewer require elementary and middle schools to set the foundation.

Lessons to Kickstart Financial Literacy in Middle School

Let’s take a look at what we know about high school freshmen. According to a 2014 survey of American 15-year-olds by the Organisation for Economic Co-operation and Development, nearly 20 percent of students stated that they hadn’t yet learned everyday financial skills, like budgeting and comparison shopping. Additionally, the 2018 Program for International Student Assessment, which analyzes and compares American 15-year-old students’ performance in reading, mathematics, and science literacy to their peers worldwide, found that there has not been a significant difference between financial literacy scores between 2012 and 2018. 15-year-olds’ financial literacy skills have seen very little improvement. Financial literacy for middle school students would help bridge this gap.

Free Middle School Financial Literacy Activities For Teachers and Parents

EVERFI offers a myriad of other free financial literacy resources for middle school students. Some great resources to take advantage of include the following:

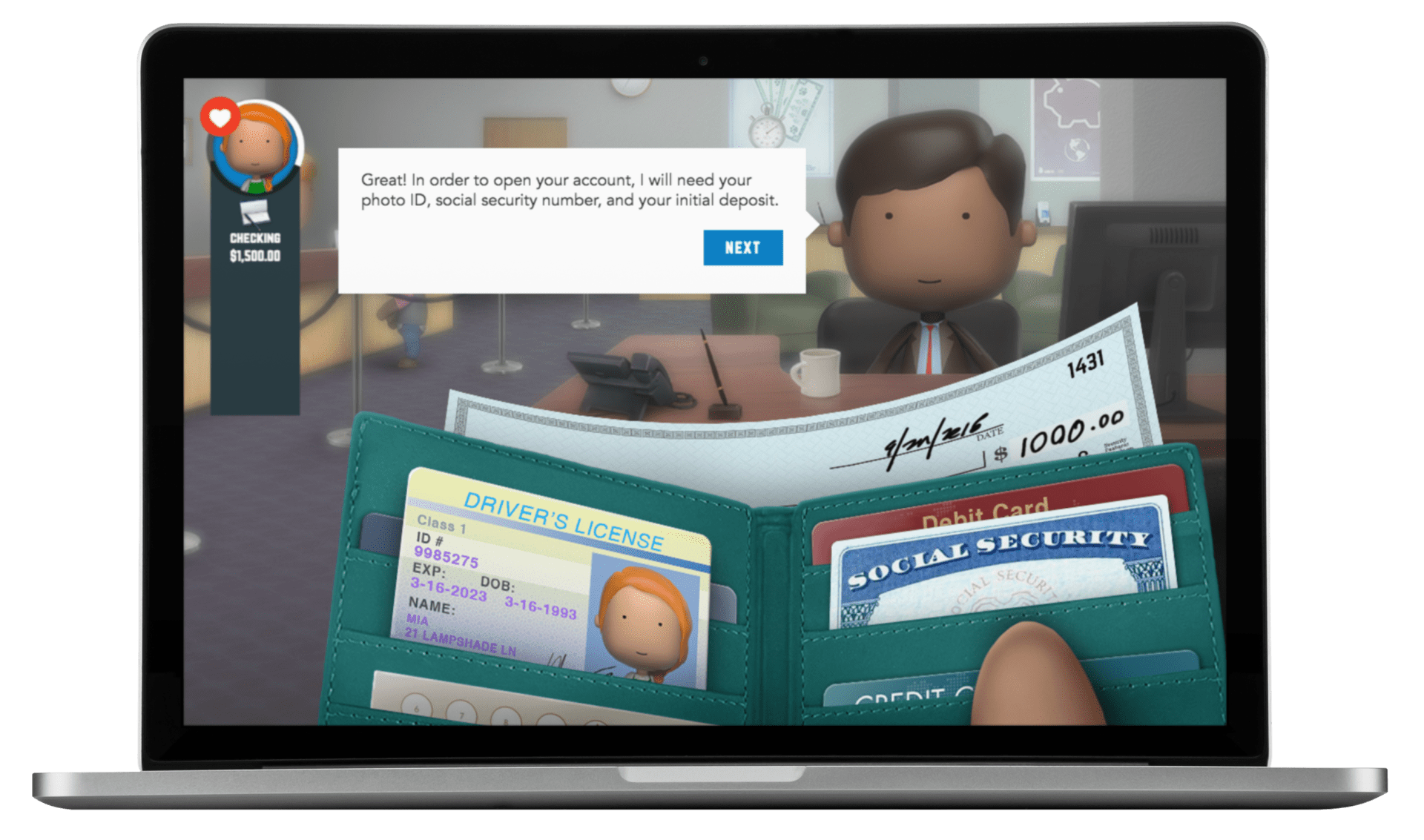

- FutureSmart provides financial literacy to kids in grades 6-8 and empowers them to effectively manage their finances, make sound decisions, and become financially responsible.

- Using Interest Rates to Teach Multiplication – Use simple interest rate activities to teach students multiplication. This not only encourages them to practice their mathematics skills but also introduces them to simple interest, an important personal finance concept.

- Career Exploration Ideas for Middle School – Help your students explore future career ideas and connect with the real world with these lesson ideas.

- Smart Shopping Lesson – Use this FutureSmart extension lesson to help your students practice smart shopping without even leaving the classroom.

- College and Career Readiness – Get your students to start thinking about their futures with this Blueprint for Success activity.

What’s the Value in Financial Literacy Curriculum for Middle School?

While it’s likely that many middle schoolers have been exposed to financial concepts at a young age, like accompanying their parents to the grocery store or listening to adults discuss budgeting, many haven’t received formal financial education in the classroom. Including financial literacy activities in middle school curriculums ensure that students begin developing their financial skills, such as money management, savings and investing, and credit and debit, early on. That way, they can carry those important and beneficial financial skills with them into their future.

Where to Start with a Middle School Financial Literacy Curriculum

Financial literacy for middle schoolers, those typically in sixth through eighth grade, should include reaching students on topics including the importance of financial responsibility, money management, and smart decision making to ensure overall financial well-being. While middle schoolers tend to understand concepts, like simple financial cost judgments and assigning values to goods and labor, they may not necessarily know how to use these concepts in their own lives. That’s where financial education comes into play.

Teaching financial literacy to middle school students can be challenging, especially because of the various concepts that many students often struggle to both understand and implement. Starting with basic concepts on financial responsibility, smart decision making, and goal setting can build the foundation for further learning and understanding and help students build skills for real-world success.