Private Labeled Financial Education for Your Community

Our private labeled financial education platform is the best way for financial institutions to provide digital financial literacy courses and resources to communities.

Use community financial education to attract and retain new consumers

Offering consumer financial education resources enables the curation of a financially literate customer base from the ground up — educating students, engaging adult consumers, and strengthening commercial partnerships. Our personalized, private labeled financial education platform enables you to reach new customers, expand your wallet share, and strengthen your brand equity all while driving visibility for your products and services.

Join Our Network of 600+ Financial Institutions

Digital Financial Education That Meets Communities Where They Are, Whatever Age They Are

School Sponsorship

School Sponsorship

Teach personal finance basics to K-12 students or sponsor a university to offer real-world financial education for young adults.

Learn more Consumer Financial Education

Consumer Financial Education

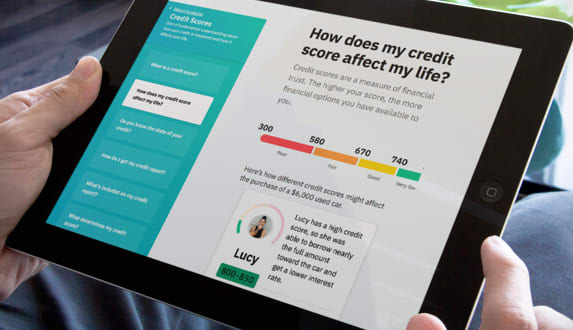

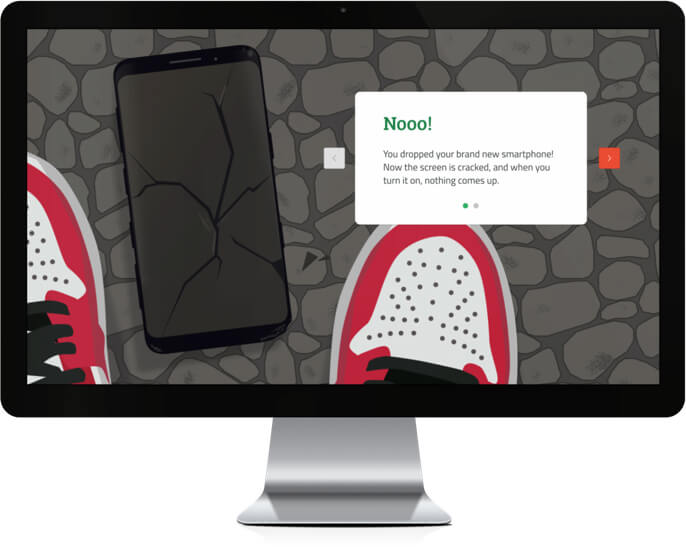

Enhance your customer experience and engage consumers with interactive, mobile-friendly content delivered through your website.

Learn more Workplace Banking

Workplace Banking

Grow commercial relationships and reach new customers when you offer personalized financial education within your Workplace Banking program.

Learn more

Achieve CRA compliance with proven CSR software and unmatched AI technology

For financial institutions, complying with the Community Reinvestment Act (CRA) is an important obligation. However, navigating the complex and ever-changing banking industry can be a challenge, which is why you need a trusted partner to help you achieve CRA compliance. EVERFI from Blackbaud’s suite of Corporate Impact solutions can help you put your comprehensive community reinvestment plan into practice. By partnering with Blackbaud’s team, financial institutions can leverage our proven CSR software and unmatched AI-powered reporting and storytelling capabilities to diversify, track, monitor, and report employee volunteerism, employee giving, corporate grantmaking, and financial education initiatives for adults and K-12 learners or to support your holistic community development efforts.

Offer workplace banking to your business partners

Offer more value to business partners with digital financial education programs designed to help reduce employee financial stress, promote financial wellness, and encourage exploration of your financial products and services.

Use digital financial education as a marketing tool

Bank marketing strategies must evolve at the pace of change in order to stay relevant to the modern consumer. Creating a digital marketing strategy for financial services is crucial to attracting and retaining consumers, and offering financial education can go a long way in building a strong brand presence.

Community Financial Education Resources

Educate yourself on new research and explore resources and templates for making impactful changes to your community financial education strategy.

Learn How EVERFI Can Help You Meet Your CSR and Social Impact Goals

Corporate social responsibility (CSR) programs provide financial institutions a way to utilize their strengths to empower their communities. Using EVERFI’s private labeled financial education platform as a CSR tool is an easy way for organizations to drive measurable impact. Offering digital financial education demonstrates an active effort to improve your community and forges a path for consumers to engage in meaningful ways with your organization.

For more information, or to see our financial education platform in action, fill out our online form, or contact us at (800) 945-2316.

Get a personalized look at our financial education solutions.

See why more than 900 financial institutions trust EVERFI's financial education solutions.