Financial Education

Pathways: Financing Higher Education

- Beginning Employment

- Budgeting

- Checking Accounts

- Consumer Skills

- Credit and Debit Basics

- Education and Financial Aid

- Education ROI

- Exploring Jobs and Careers

- Filing Your Taxes

- Insurance Basics

- Savings Accounts

- Smart Money Habits

Why Adopt This Course?

This free digital course empowers students to become informed consumers and make wise financial decisions when choosing how to finance their higher education. Through interactive real-world scenarios, students learn how to evaluate the return on investment (ROI) of higher education options and research how to pay for it.

At-A-Glance

Grade Level

9th, 10th, 11th, 12thLength

5 digital lessons, 15 min each

Languages

Standards

Jump$tart National Standards in K–12 Personal Finance Education

Curriculum Fit

Finance, Economics, CTE, Counseling, Business, and Advisory

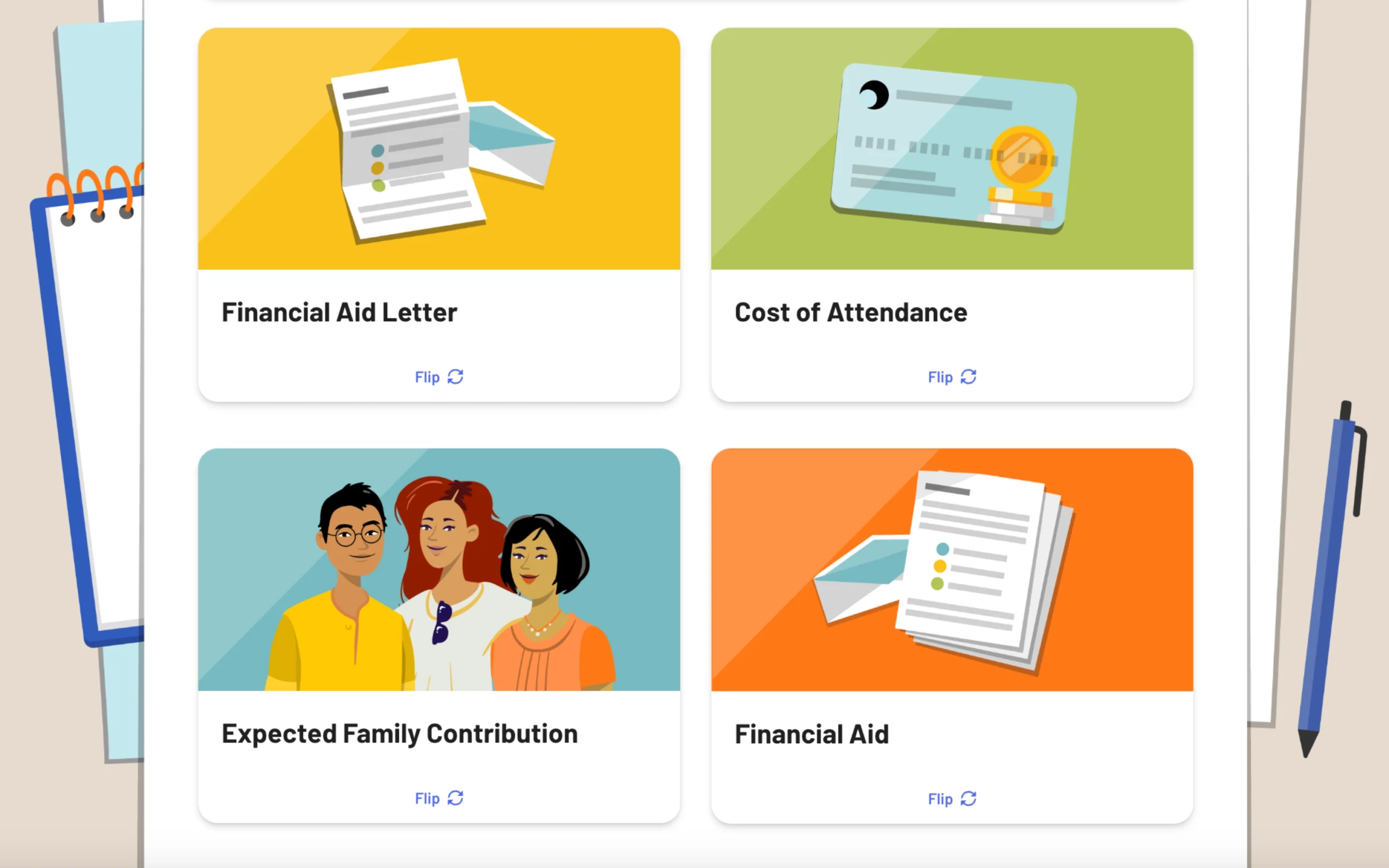

Students learn how to evaluate the return on investment (ROI) of different higher education options related to the choice of a major or a career path and the true costs of attendance.

Students learn how to pay for their higher education by seeking out free options like scholarships and grants first. They also explore the steps to complete and submit the FAFSA and the importance of doing so.

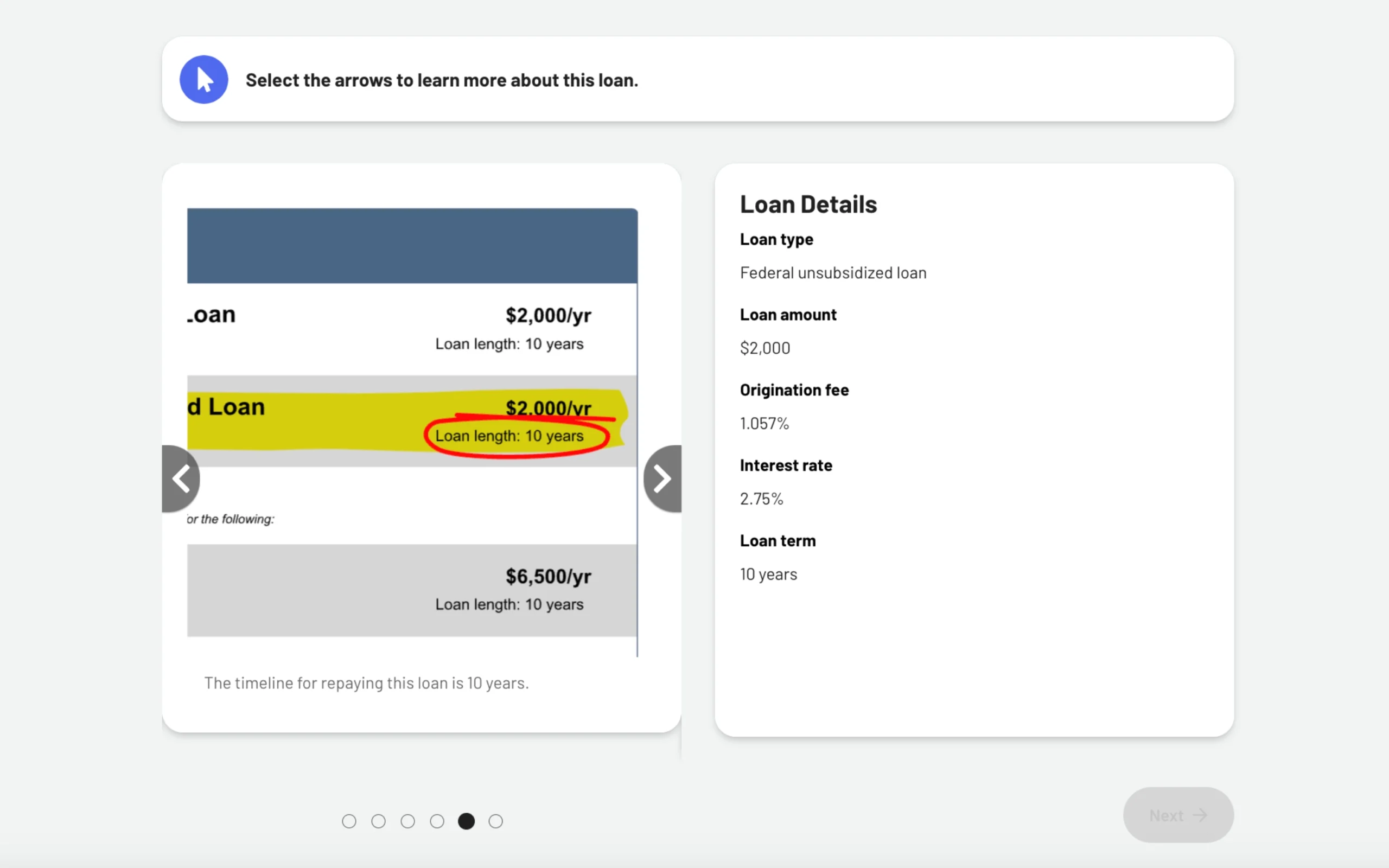

Students learn how loans work, including different types of loans and their associated fees. They also investigate how interest rates work and how they impact overall payments.

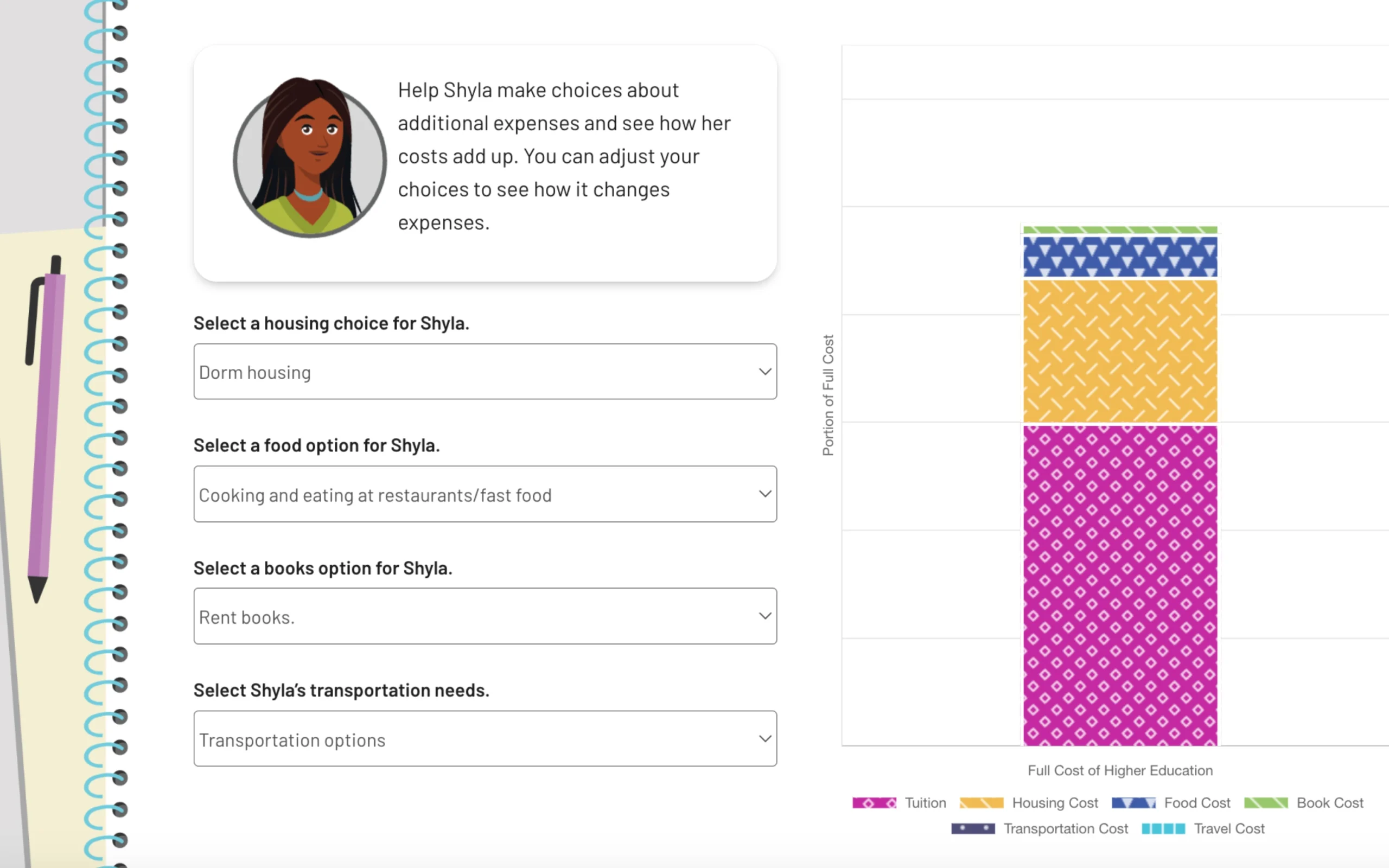

Students calculate financial aid costs in relation to their personal budget and understand the full cost of a loan, as well as how repayment works.

Students learn about the potential impact of a high debt load from higher education loans and how to take steps to manage their debt responsibly.

Why Everfi?

Everfi empowers educators to bring real-world learning into the classroom and equip students with the skills they need for success-now and in the future. Our curriculum and courses are:

- Loved by 750,000+ teachers

- Aligned to US, Canada, and UK learning standards.

- Real-world lessons that are self-paced and interactive.

- Automatically graded with built-in assessments and reporting.

- Extendable with activities and resources to bring the information to life.

- Supported with a dedicated, regional team.

- Forever free for K-12 educators.

How Are These Lessons Free?

Thanks to the generous sponsorship of corporations who share our mission, Everfi’s courses are completely free to teachers, districts, and families

This course is made possible through partnerships with community-focused financial institutions who invest in student financial literacy. That’s why everything—curriculum, training, and support—is completely free to educators.