How Banks Can Make a Larger Impact in Their Communities

Banks are more than financial institutions — they are anchors of trust, stability, and opportunity. Today’s consumers expect banks to go beyond transactions and play an active role in addressing local needs. From advancing financial education to supporting small businesses, community impact isn’t just a nice-to-have; it’s a strategic advantage.

Rethinking Community Impact in Modern Banking

The role of banks is evolving. Customers are looking for financial institutions that understand their values, contribute to local progress, and help close opportunity gaps. With the rise of purpose-driven business models, community engagement is no longer viewed as philanthropy — rather, it’s a key pillar of customer loyalty and brand reputation.

Banks that intentionally invest in their communities strengthen both their social impact and their business outcomes. Programs that support financial wellness, affordable housing, and small business ecosystems can foster trust while driving sustainable growth.

Align Community Investment with Institutional Strengths

Every bank has unique assets — from deep community relationships to financial expertise and lending power — that can be harnessed for social good. The most effective community engagement strategies build on those core strengths.

Here’s how banks can start:

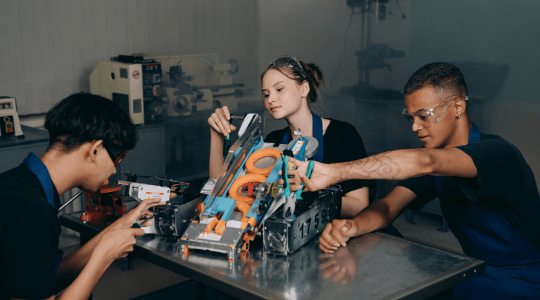

- Advance financial literacy with a career focus: Offer digital financial education programs that connect classroom learning to workforce readiness, helping students and adults build real-world skills.

- Invest in small business ecosystems: Provide workshops, mentorship, and microloans that help local entrepreneurs grow, especially those in underrepresented communities.

- Empower communities through measurable financial education: Use digital learning platforms to deliver engaging, locally relevant courses that build financial confidence across all age groups to help close knowledge gaps while providing data insights that demonstrate measurable community impact and CRA alignment.

Expanding Community Impact Strategically

The Community Reinvestment Act (CRA) sets the foundation for community development, but leading banks are treating it as a starting point — not a finish line. Examples of CRA-aligned initiatives that go further:

- Volunteer-led financial education: Employees teach financial wellness in schools, earning CRA credit while strengthening community relationships.

- Workplace banking programs: Offering educational resources and access to fair financial products directly through employers.

- Digital inclusion programs: Partnering with local organizations to provide digital banking literacy and access to online financial tools.

These efforts not only meet compliance standards but also create measurable social and business value.

Strengthen Community Trust Through Transparency and Accountability

Trust is the foundation of any community relationship. Banks can strengthen it through transparent communication and measurable impact reporting. Effective strategies include:

- Publishing community impact reports: Share real data on volunteer hours, financial education reach, and lending outcomes.

- Engaging local advisory boards: Involve community members in shaping outreach priorities and evaluating progress.

- Regular feedback loops: Use surveys or community listening sessions to ensure programs reflect evolving needs.

When communities see authentic, transparent action, trust deepens — and loyalty follows.

Leverage Internal Culture to Amplify External Impact

A strong internal culture of giving back amplifies a bank’s external impact. Employees are often eager to contribute — they just need the structure and encouragement to do so. Here are some ways to foster a culture of community engagement:

- Offer paid volunteer time: Make it easy for employees to give back without financial sacrifice.

- Celebrate community champions: Highlight employees who lead volunteer or mentorship efforts.

- Align purpose with performance: Integrate social impact goals into employee development and recognition programs.

Questions to Guide Strategic Community Engagement

To elevate your community impact strategy, start by asking:

- How well do our current initiatives align with our institutional strengths and customer needs?

- Are we measuring the outcomes of our programs — not just participation?

- What partnerships can expand our reach into underserved communities?

- How can we embed financial education into our business banking relationships?

Everfi partners with financial institutions to design and deliver education programs that empower communities and strengthen business relationships. From K-12 personal finance to adult financial wellness and small business education, Everfi provides scalable, data-driven solutions that turn good intentions into measurable impact.