How Banks Can Support Career Connected Learning in Their Community

Communities across the U.S. are facing a dual challenge: a widening talent gap and persistent opportunity inequities. Research indicates that 71% of hiring managers report difficulty finding skilled talent. At the same time, banks face hurdles in their own workforce – aging employee pipelines, digital transformation needs, and growing pressure to demonstrate commitment to economic mobility and equity.

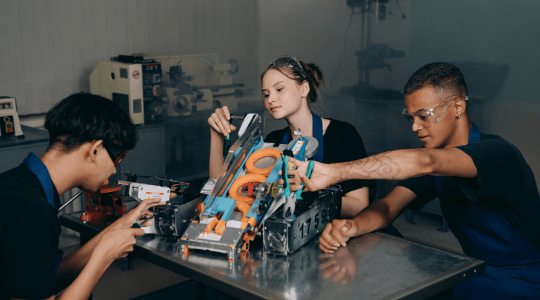

Career-connected learning is a smart, scalable way for banks to address both challenges. These programs introduce students to real-world career pathways, develop critical life and financial skills, and build long-term trust within the community. And when done thoughtfully, they can also support goals tied to the Community Reinvestment Act (CRA), corporate social responsibility (CSR), and diversity, equity, and inclusion (DEI).

Five Ways Banks Can Engage with Career-Connected Learning

By engaging students early and helping them envision pathways into banking and finance, financial institutions can close this gap while creating real impact in their communities. Here are some ways to support career-connected learning across a spectrum of effort and investment:

- Guest Speaking and Career Day Participation: Participating in local school career days or speaking in classrooms gives students early exposure to banking careers and helps humanize the industry.

- Financial Literacy and Career Skills Programs: Banks can sponsor online or in-classroom learning experiences that teach students core financial concepts alongside insights into financial services careers. Everfi’s K–12 digital learning courses are an excellent tool for this.

- Job Shadowing and Internships: Offer structured opportunities for high school students to spend time in your branches or corporate offices to understand different career paths.

- Mentorship Programs: Pair bank employees with students for ongoing mentorship. These relationships build social capital and give students a trusted adult to help them navigate career decisions.

- Apprenticeships and Work-Based Learning: Partner with local school districts or community colleges to provide longer-term, paid learning experiences for students—especially those underrepresented in the financial sector.

Integrating Career-Connected Learning with Existing CSR, CRA, and DEI Strategies

Career-connected learning doesn’t need to be a standalone initiative. In fact, it’s most effective when integrated into your existing outreach strategies.

Corporate Social Responsibility (CSR): Use career-connected learning to demonstrate your commitment to youth development and economic mobility:

- Sponsor high-impact digital learning programs in local schools

- Host resume-writing workshops or interview prep events

- Share employee stories that reflect diverse career paths

Community Reinvestment Act (CRA): Investments in education and workforce readiness programs for low- and moderate-income students may qualify for CRA credit:

- Document volunteer hours spent mentoring or speaking at schools

- Partner with financial education providers like Everfi to reach underserved communities

- Include education efforts in CRA performance evaluations

Diversity, Equity & Inclusion (DEI): Career exposure programs help diversify your talent pipeline by supporting underrepresented students:

- Collaborate with affinity groups to create mentorship programs

- Focus outreach on Title I schools and marginalized communities

- Providing bilingual education materials where needed

Program Implementation Considerations

- Building Internal Buy-In: Secure leadership support early by aligning programs with existing business objectives, such as employee engagement or CRA performance.

- Identifying Community Needs: Partner with school districts, workforce boards, or local nonprofits to identify the most pressing skill gaps and tailor your programming accordingly.

- Measuring Success: Track metrics like student reach, skill gains, and employee volunteer hours. Consider surveying student participants for feedback to improve future programs.

Make an Impact on Your Community With Everfi

Career-connected learning is more than a nice-to-have—it’s a smart, sustainable strategy for workforce development and community impact. Banks that invest in the next generation of customers not only build trust—they build their future workforce. Explore our financial education solutions.