Marketplaces: Investing Basics

- Investing Basics

- Investing Process

- Investment Game

- The Right Financial Advisor

- The Stock Exchange

Why Adopt This Course?

Give students essential investment skills for long-term financial success with this comprehensive course that demystifies the stock market and builds investing confidence. Through interactive, real-world scenarios, students learn how the stock exchange works, explore different investment strategies, and understand the power of compound growth over time. Students also discover when and how to work with financial advisors, giving them practical knowledge they’ll use throughout their adult lives. Designed to meet financial education standards with complete lesson guides and minimal prep time required—perfect for economics, business, or personal finance classes.

At-A-Glance

Grade Level

9th, 10th, 11th, 12thLength

5 digital lessons, 20 min each

Languages

Standards

Jump$tart National Standards in K–12 Personal Finance Education

Curriculum Fit

Economics, Finance, FACS, CTE, Social Studies, Business, and AVID

Students are introduced to the stock exchange’s role in the global economy. They’ll also begin to examine what it means to be a shareholder and how major events can impact the stock exchange and stock pricing.

Students are introduced to investing by exploring the different types of financial assets, how investing differs from savings, and reasons for choosing to invest.

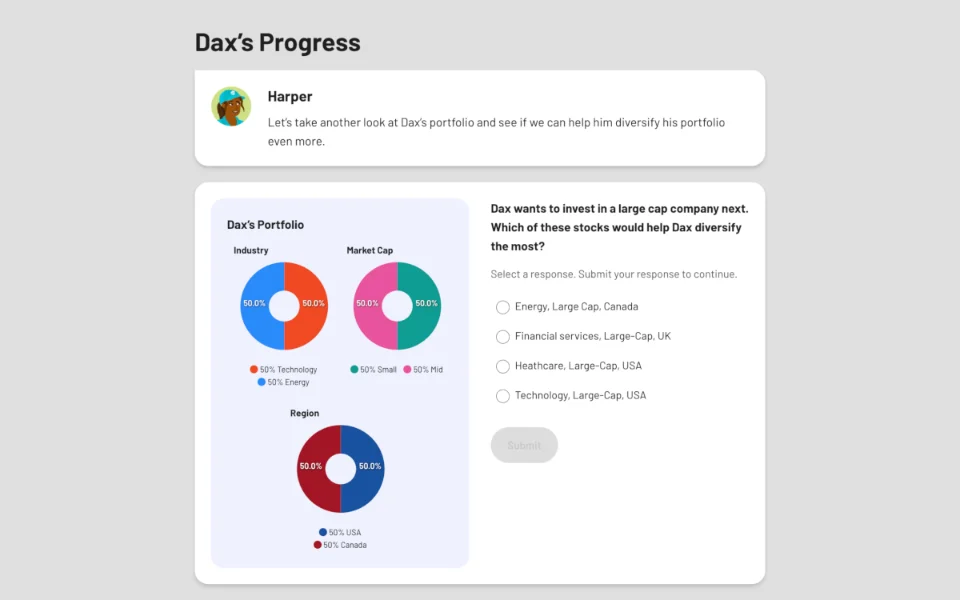

Students begin to practice making investment decisions based on diversification and individual needs. They learn to consider risk, time horizon, asset allocation, and diversification to make investment decisions with financial goals in mind.

Students explore the reasons that a person might want to hire a financial professional to manage their investments or provide investment advice.

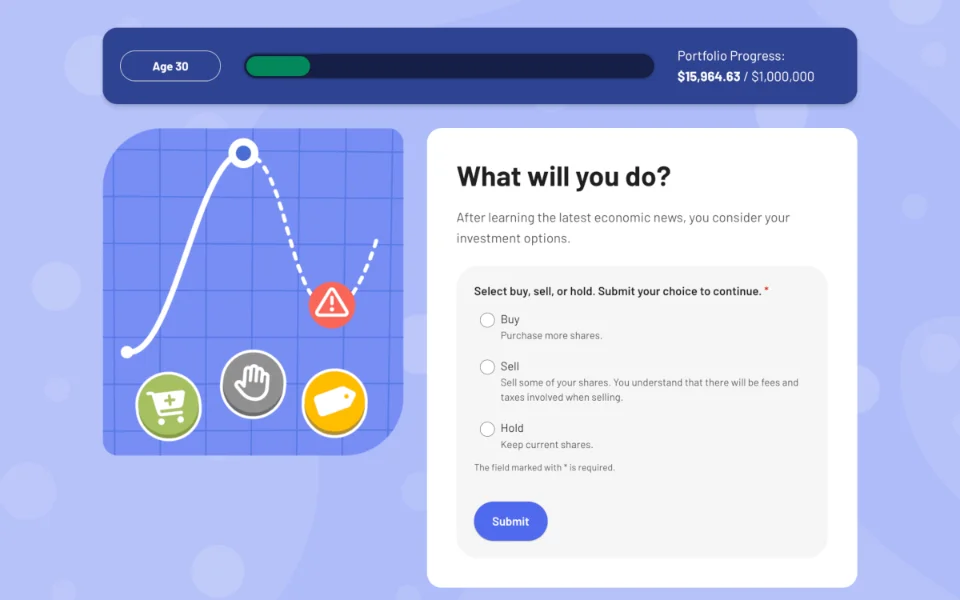

Students apply knowledge from the previous lessons in a game where they grow their investment portfolio by making smart investment decisions as they address various financial situations.

-

Less than a third of high school juniors and seniors reported that they felt prepared to compare financial institutions and select one that best meets their needs (32%). Slightly more students — but still less than half (47%) — felt they could select, open, and manage a savings or checking account.

Young people also reported low levels of confidence in their ability to establish financial habits that contribute to long-term financial wellbeing: budgeting and managing credit. Half of juniors and seniors said they were “prepared” or “very prepared” to set up and follow a budget, while just a third (32%) felt they could check their credit and maintain good credit over time.

These skills budgeting and managing credit – are essential as young people move toward financial independence. The decisions they make in the next one to two years begin to carry consequences that can last much longer, directly impacting their lifetime financial wellbeing.

-

Yes, given the critical role of skill and confidence in building financial wellbeing, the low levels of preparedness among young people could be a sign of trouble as students finish high school and move toward financial independence.

-

Students learn the fundamentals of money management in financial literacy classes, including budgeting, saving, paying off debt, investing, and more. This information offers the groundwork for kids to establish sound financial practices at a young age and steer clear of many mistakes that result in ongoing financial difficulties.

Why Everfi?

Everfi empowers educators to bring real-world learning into the classroom and equip students with the skills they need for success-now and in the future. Our curriculum and courses are:

- Loved by 750,000+ teachers

- Aligned to US, Canada, and UK learning standards.

- Real-world lessons that are self-paced and interactive.

- Automatically graded with built-in assessments and reporting.

- Extendable with activities and resources to bring the information to life.

- Supported with a dedicated, regional team.

- Forever free for K-12 educators.

How Are These Lessons Free?

Thanks to the generous sponsorship of corporations who share our mission, Everfi’s courses are completely free to teachers, districts, and families