Health and Wellness

Understanding Mental Wellness

- Creating a Supportive Mental Wellness Plan

- Introduction to Mental Health

- Mental Health Coping Strategies

- Seeking and Offering Support

- Staying Healthy in Times of Uncertainty

- Understanding Mental Health Challenges

Why Adopt This Course?

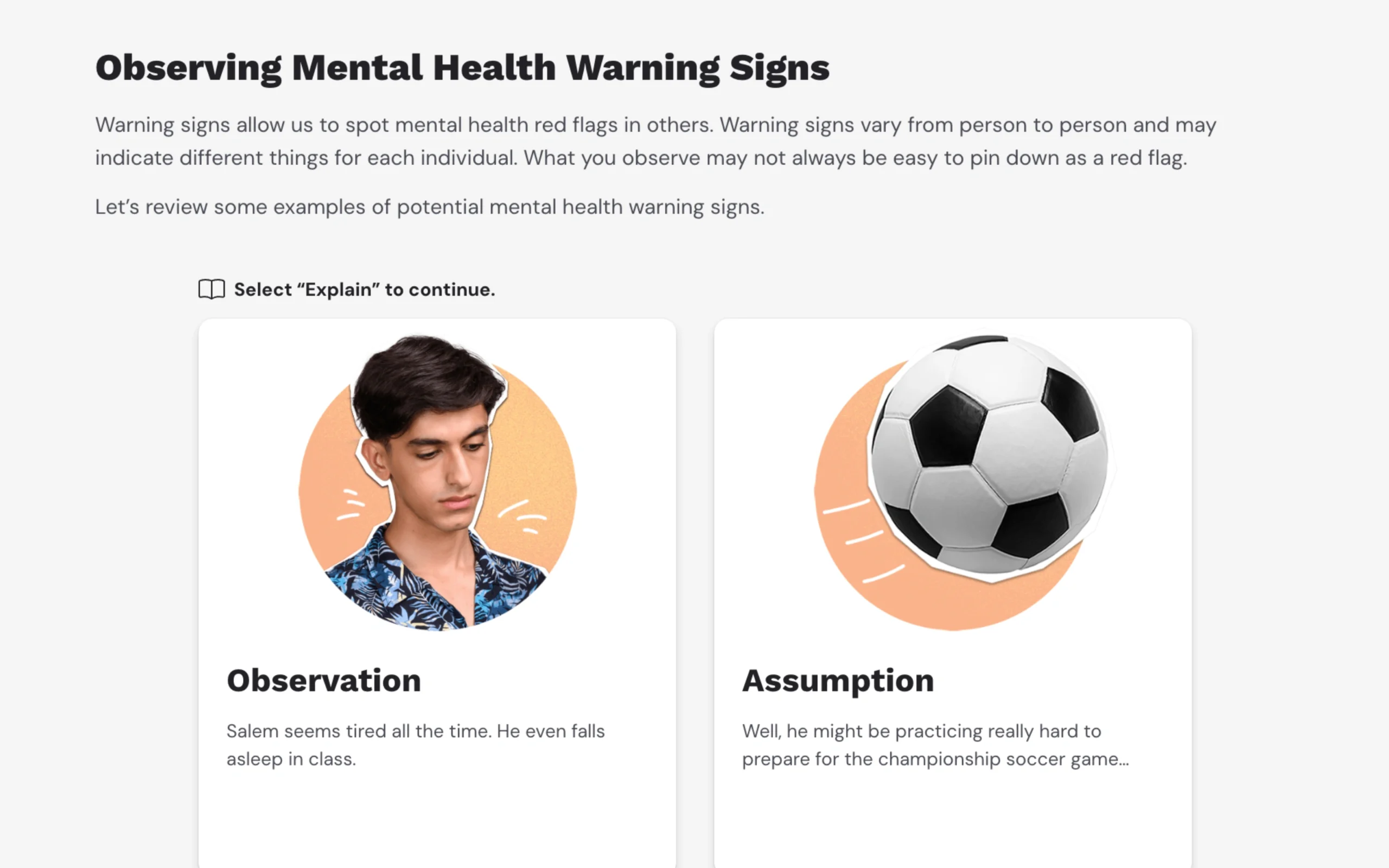

Give students essential mental health skills for today’s world with this comprehensive course that addresses the real challenges teens face. Through interactive, research-based scenarios, students learn practical coping strategies to manage stress, anxiety, and difficult emotions while building resilience and emotional intelligence. Students also develop skills to support friends and family members who may be struggling, recognize warning signs that require professional help, and access appropriate mental health resources in their community. Designed for easy implementation in health, advisory, or counseling settings with complete lesson guides and minimal prep time required.

At-A-Glance

Grade Level

8th, 9th, 10th, 11th, 12thLength

6 digital lessons, 15 mins each

Languages

Standards

National Health Education Standards (NHES)

Curriculum Fit

Health, Counseling, Advisory, and Homeroom

Students learn what mental wellness is and recognize the factors that maintain and contribute to positive mental health. The lesson also defines stress and explains how it interacts with mental health.

Students learn the difference between mental wellness and mental illness and explore how the brain is impaired in some common disorders that affect their age group.

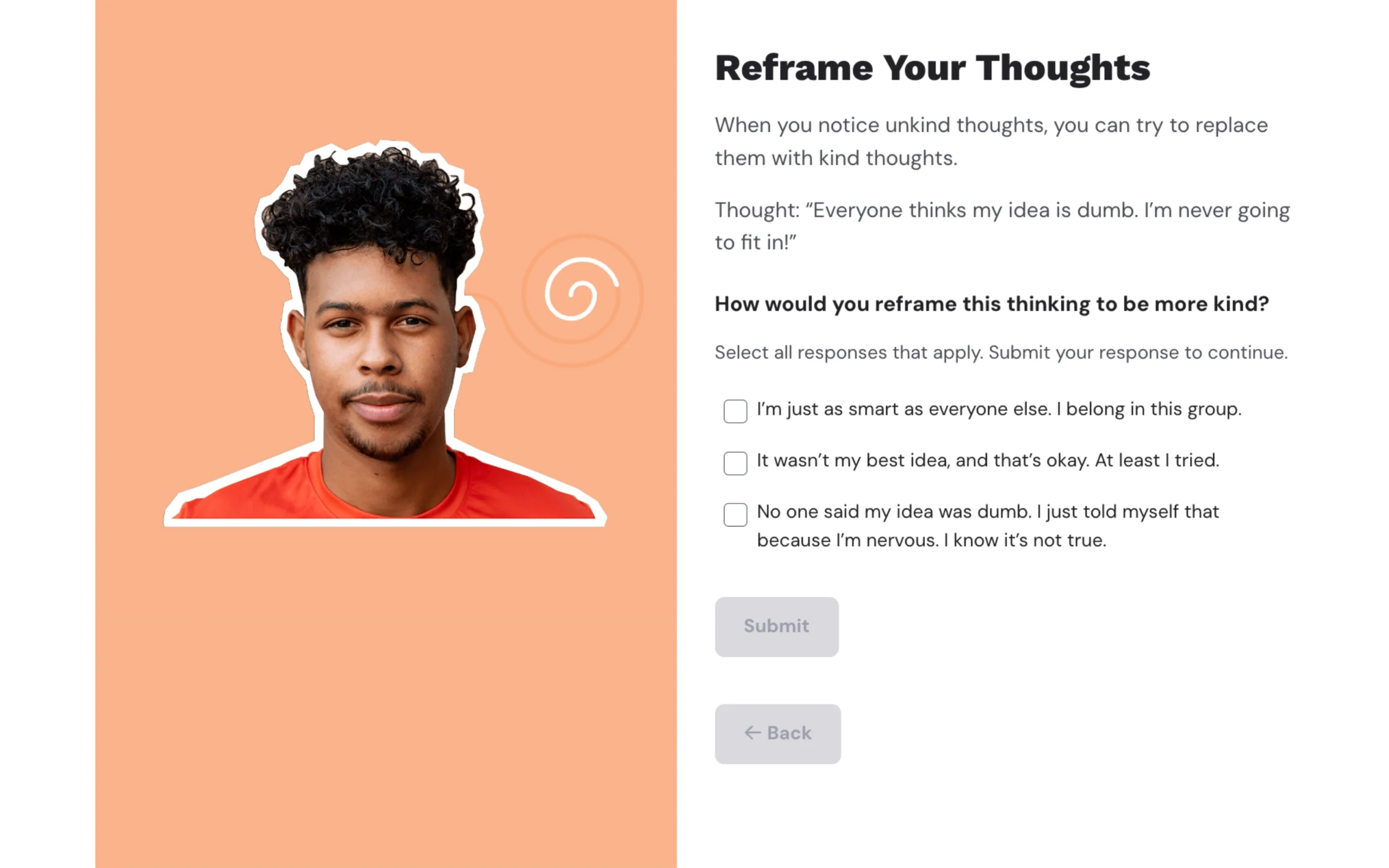

Students learn what coping strategies are and how they can be used to deal with life’s challenges and support mental health. Students also have the option to practice five coping strategies.

Students learn the ways that changes outside of our control impact mental health. The lesson also explores the importance of resiliency and coping strategies specific to times of change and uncertainty.

Students learn how to recognize when help is needed and how to access it for oneself and to encourage others to seek help when needed. The lesson also addresses stigma and how it can hinder help-seeking behaviors.

Students are given the opportunity to practice what they’ve learned throughout lessons 1-5 while also developing their own personal mental wellness strategy.

Why Everfi?

Everfi empowers educators to bring real-world learning into the classroom and equip students with the skills they need for success-now and in the future. Our curriculum and courses are:

- Loved by 750,000+ teachers

- Aligned to US, Canada, and UK learning standards.

- Real-world lessons that are self-paced and interactive.

- Automatically graded with built-in assessments and reporting.

- Extendable with activities and resources to bring the information to life.

- Supported with a dedicated, regional team.

- Forever free for K-12 educators.

How Are These Lessons Free?

Thanks to the generous sponsorship of corporations who share our mission, Everfi’s courses are completely free to teachers, districts, and families

This course is made possible through partnerships with community-focused financial institutions who invest in student financial literacy. That’s why everything—curriculum, training, and support—is completely free to educators.