Overview

EVERFI: Financial Literacy for High School

This newly updated financial literacy foundations course teaches students how to make informed financial decisions that promote financial well-being over their lifetime. The interactive lessons translate complex financial concepts in ways that help students develop actionable strategies for managing their finances. This course has been updated to more comprehensively address financial education standards and increase student engagement with new interactive elements.

Free Digital Lessons for

Students in Grades 9-12

At-A-Glance

Grade Level:

9-12

Languages:

English and Spanish

Length:

12 digital lessons, 20 min each

Curriculum Fit:

Economics, Financial Algebra, FCS, Business, AVID, and Advisory

Standards:

Jump$tart National Standards in K–12 Personal Finance Education

Preview the Digital Lessons

Lesson 1

Consumer Skills

Lesson 2

Smart Money Habits

Lesson 3

Budgeting

Lesson 4

Filing Your Taxes

Lesson 5

Checking Accounts

Lesson 6

Savings Accounts

Lesson 7

Credit and Debt Basics

Lesson 8

Education ROI

Lesson 9

Education and Financial Aid

Lesson 10

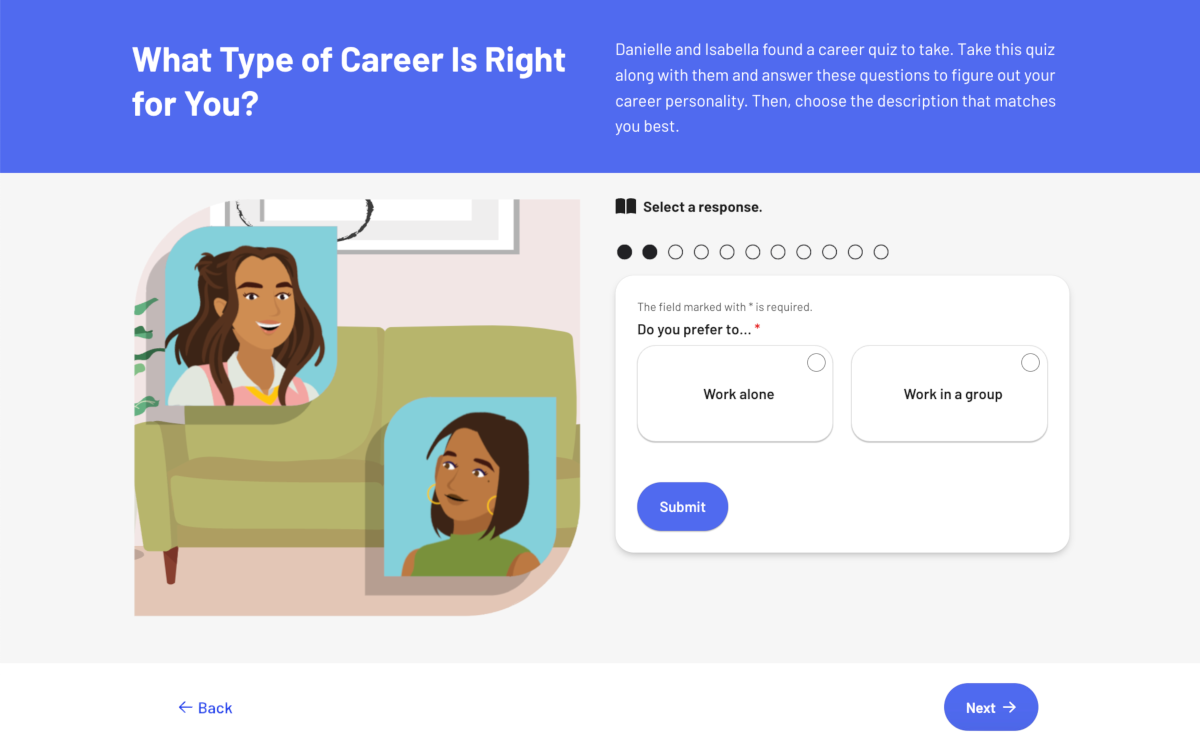

Exploring Jobs and Careers

Lesson 11

Beginning Employment

Lesson 12

Insurance Basics

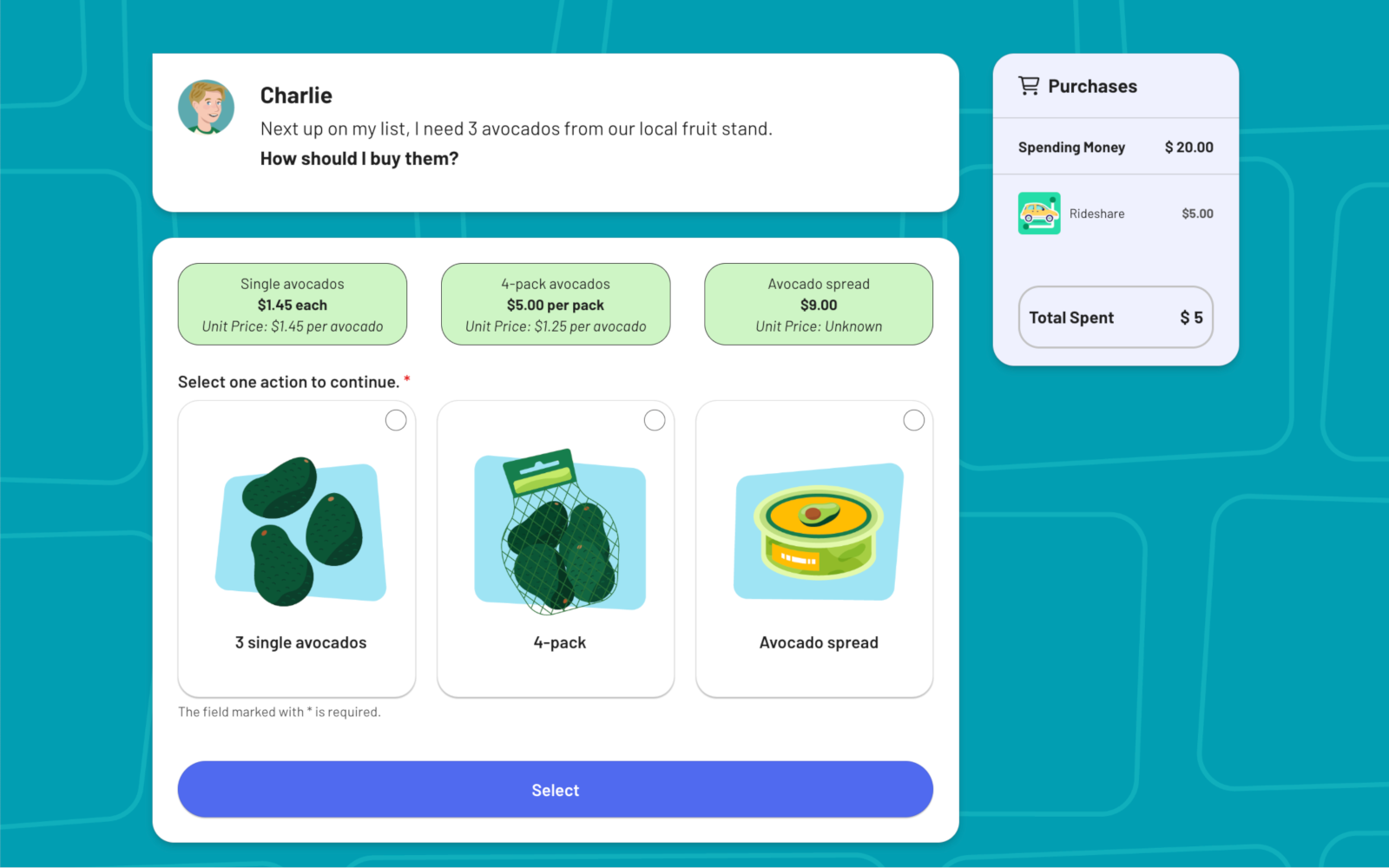

Lesson 1

Consumer Skills

Students gain an understanding of what it means to be a skilled consumer. They also assess the quality of sources when researching products to buy.

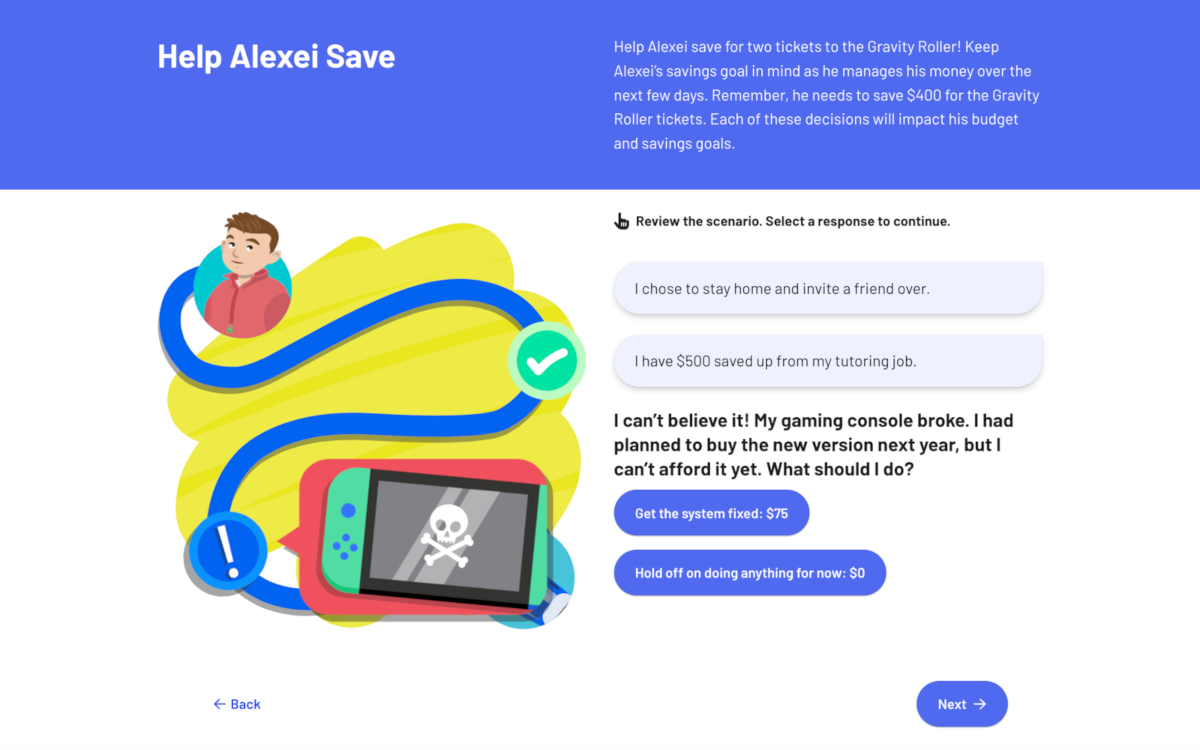

Lesson 2

Smart Money Habits

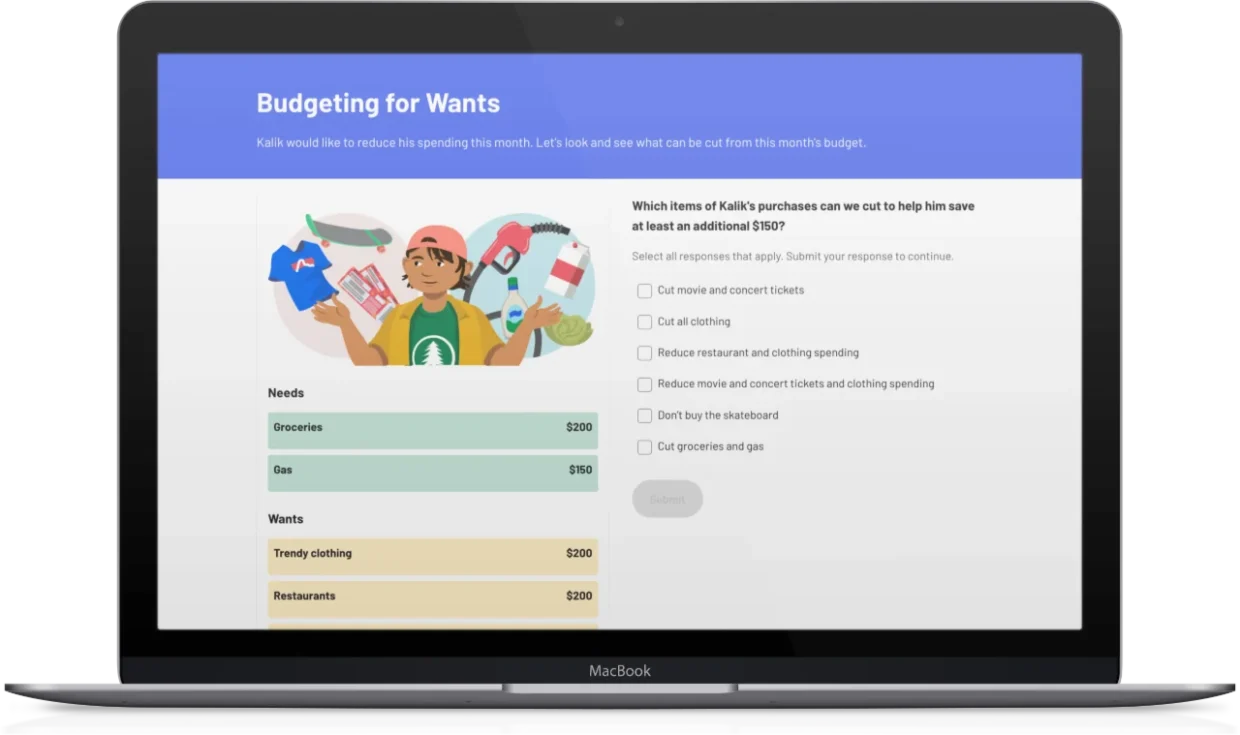

Lesson 3

Budgeting

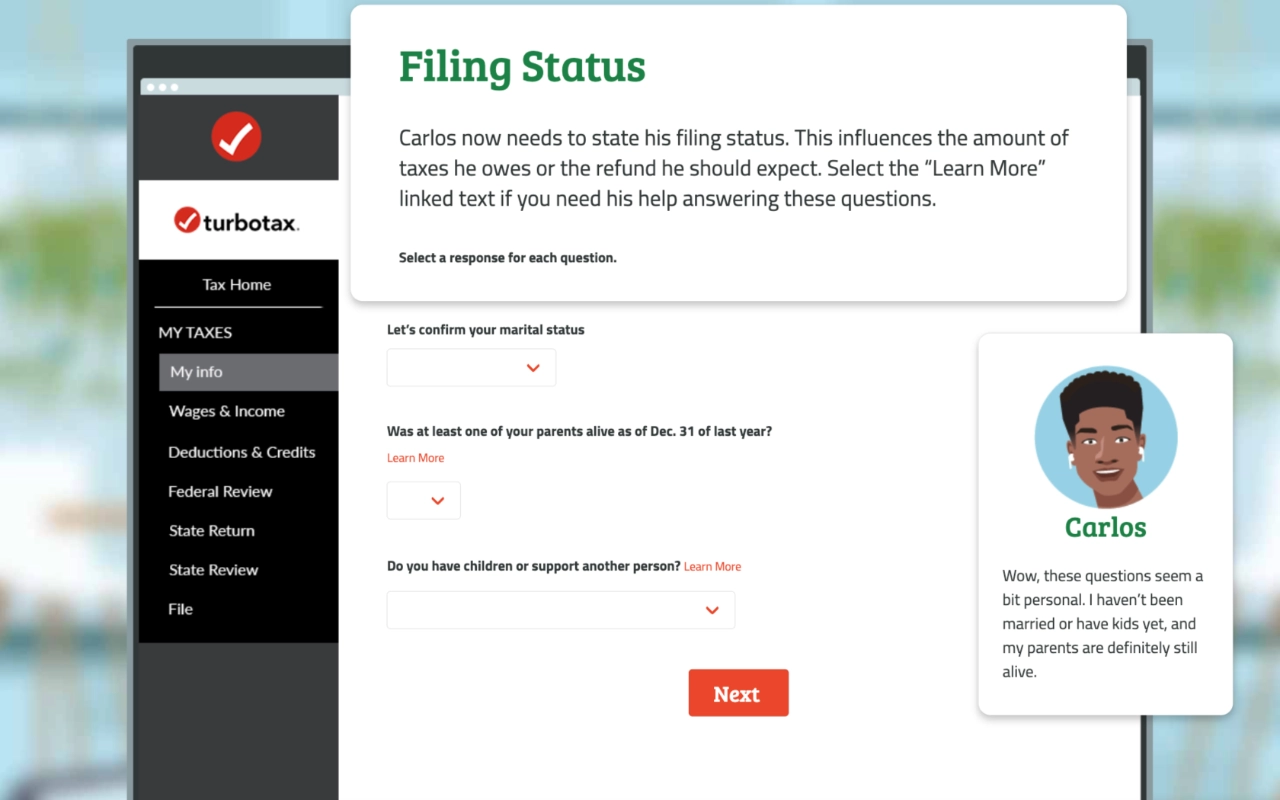

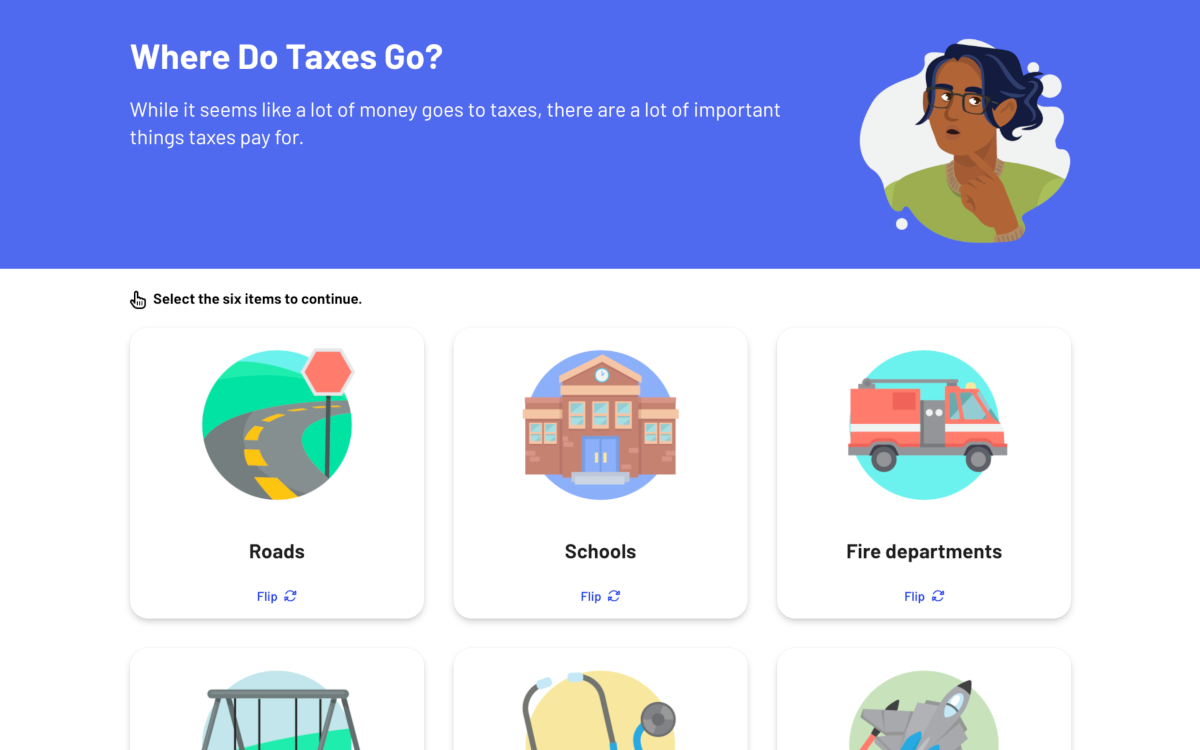

Lesson 4

Filing Your Taxes

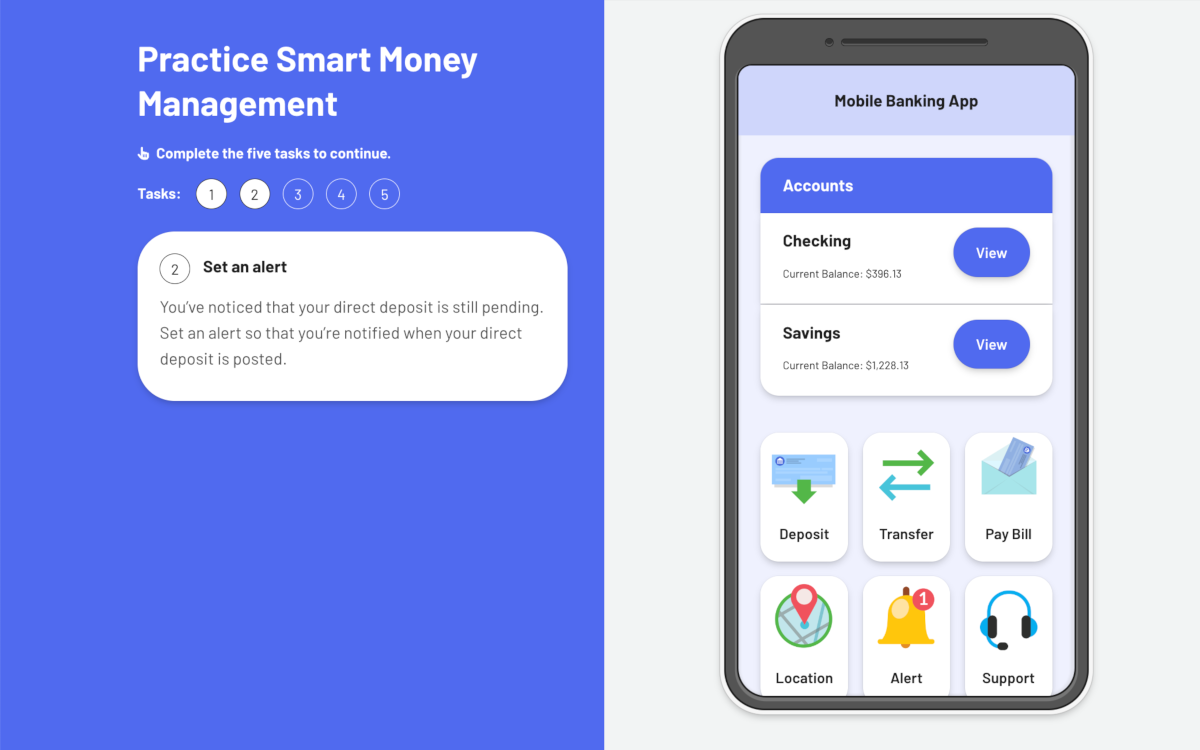

Lesson 5

Checking Accounts

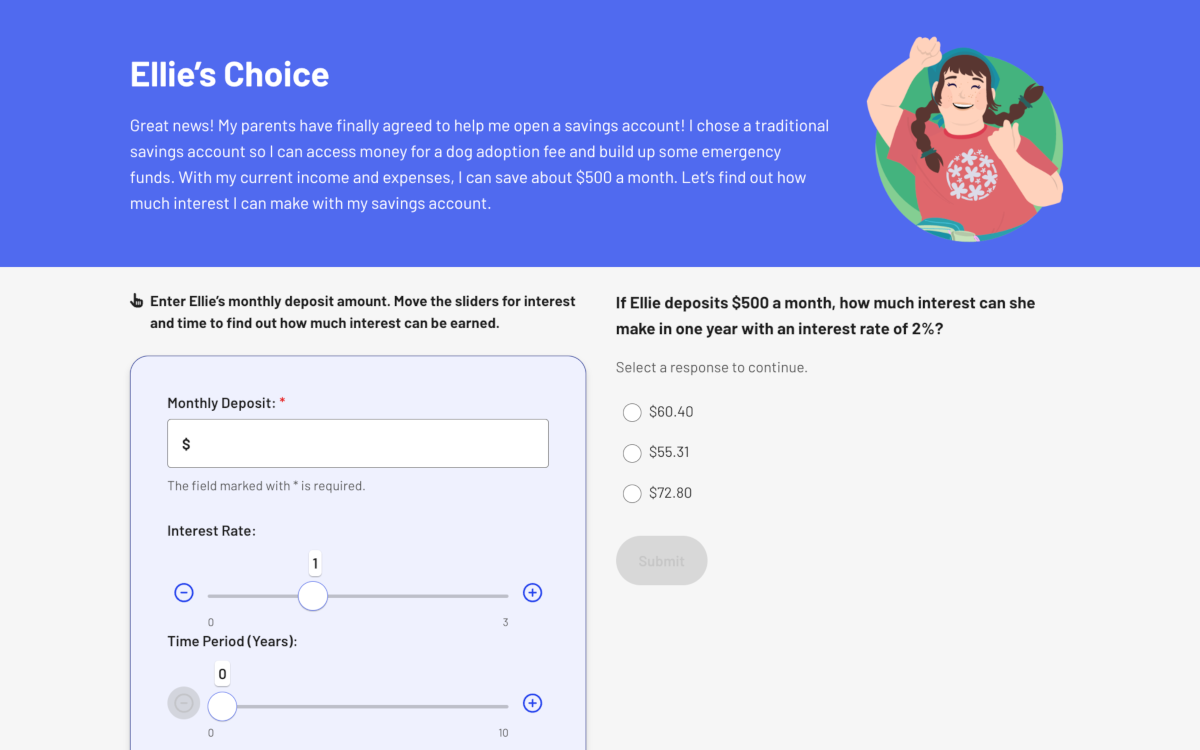

Lesson 6

Savings Accounts

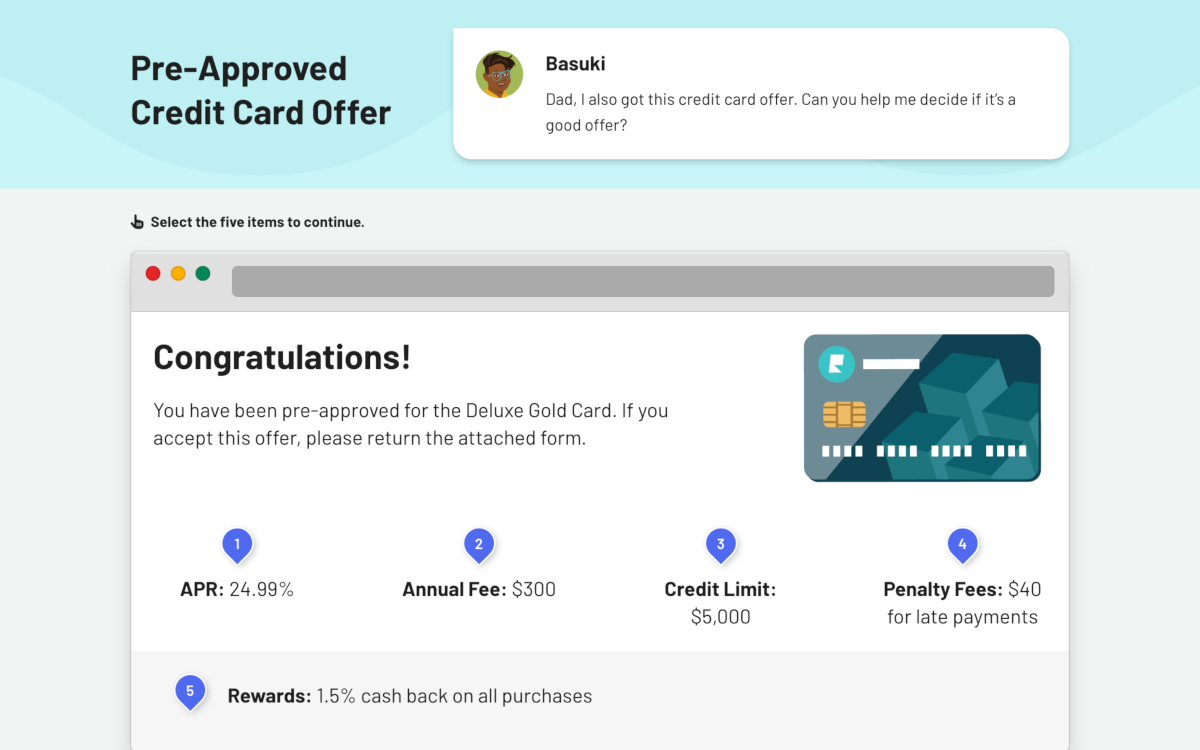

Lesson 7

Credit and Debt Basics

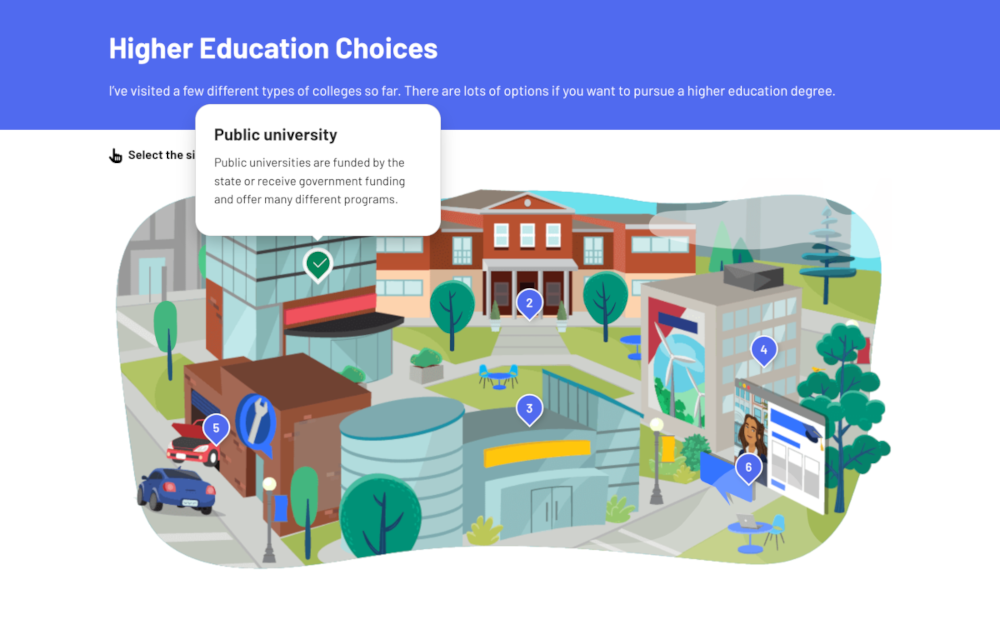

Lesson 8

Education ROI

Lesson 9

Education and Financial Aid

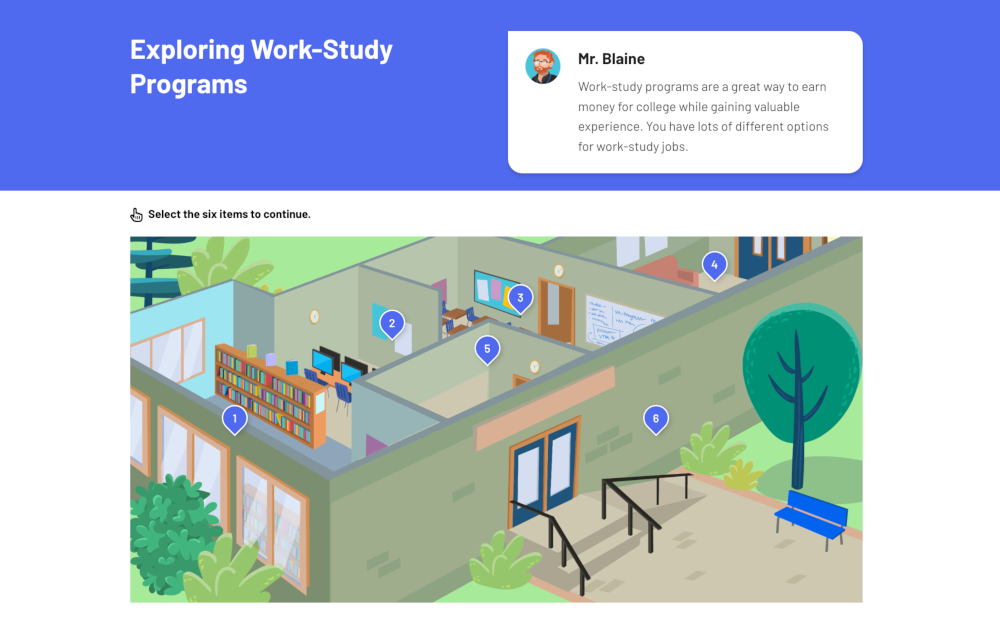

Lesson 10

Exploring Jobs and Careers

Lesson 11

Beginning Employment

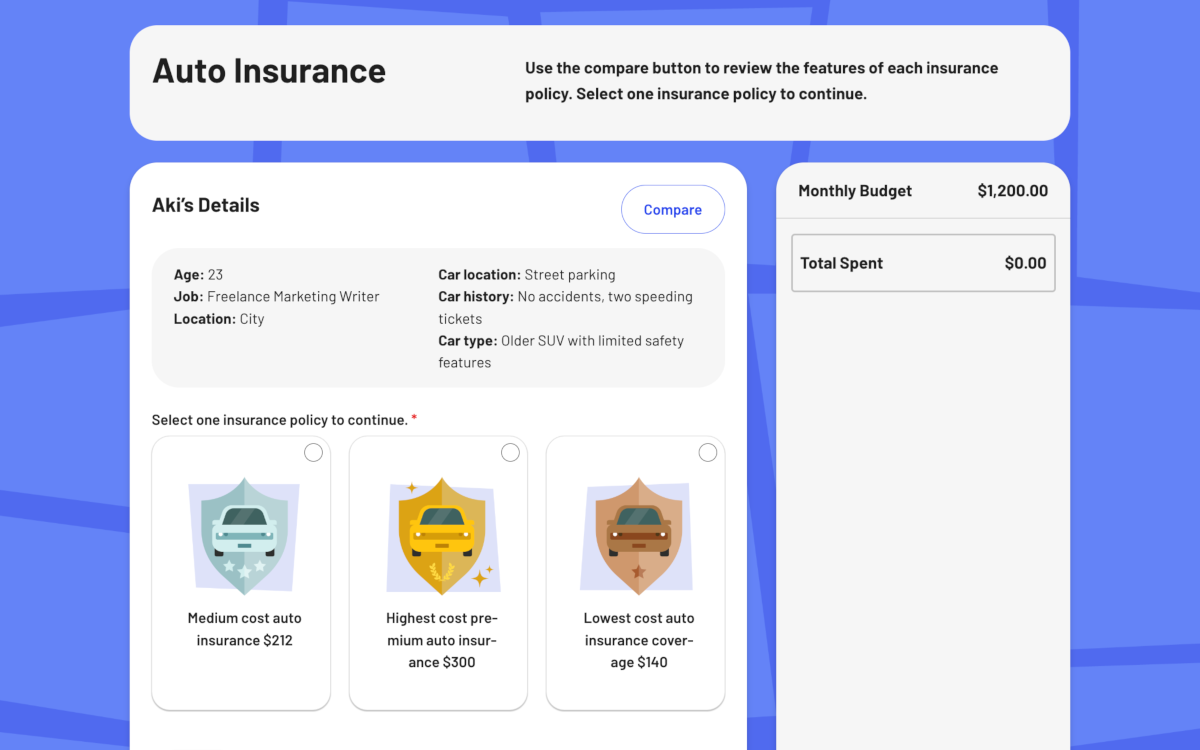

Lesson 12

Insurance Basics

Why Teachers & Students Love This Course

Try Pairing This Course With

Marketplaces:

Investing Basics

Tax Simulation:

Understanding Taxes

Teaching Financial Literacy FAQ

Less than a third of high school juniors and seniors reported that they felt prepared to compare financial institutions and select one that best meets their needs (32%). Slightly more students -- but still less than half (47%) -- felt they could select, open, and manage a savings or checking account.

Young people also reported low levels of confidence in their ability to establish financial habits that contribute to long-term financial wellbeing: budgeting and managing credit. Half of juniors and seniors said they were “prepared” or “very prepared” to set up and follow a budget, while just a third (32%) felt they could check their credit and maintain good credit over time.

These skills budgeting and managing credit – are essential as young people move toward financial independence. The decisions they make in the next one to two years begin to carry consequences that can last much longer, directly impacting their lifetime financial wellbeing.

Yes, given the critical role of skill and confidence in building financial wellbeing, the low levels of preparedness among young people could be a sign of trouble as students finish high school and move toward financial independence.

Students learn the fundamentals of money management in financial literacy classes, including budgeting, saving, paying off debt, investing, and more. This information offers the groundwork for kids to establish sound financial practices at a young age and steer clear of many mistakes that result in ongoing financial difficulties.