Financial Education

Tax Simulation: Understanding Taxes

- Filing Your Taxes

- Tax Credits for Families

- Taxes for Gig Workers

- Taxes for Investments

- Taxes for Students

Why Adopt This Course?

Give students essential tax skills they’ll use immediately after graduation with this hands-on course developed with Intuit for Education. Through a high-fidelity, guided experience navigating TurboTax tax preparation software, students gain confidence by practicing real tax scenarios covering filing basics, tax credits, gig work taxes, student-specific situations, and investment taxes. This practical course builds financial confidence while preparing students for a responsibility they’ll face every year as adults. Complete with instructional videos and step-by-step guidance, the course requires minimal teacher prep while delivering skills students will actually use in their lives.

At-A-Glance

Grade Level

9th, 10th, 11th, 12thLength

5 digital lessons, 45 min total

Languages

Standards

Jump$tart National Standards in K–12 Personal Finance Education

Curriculum Fit

Finance, Economics, CTE, Social Studies, Business, FCS, and AVID

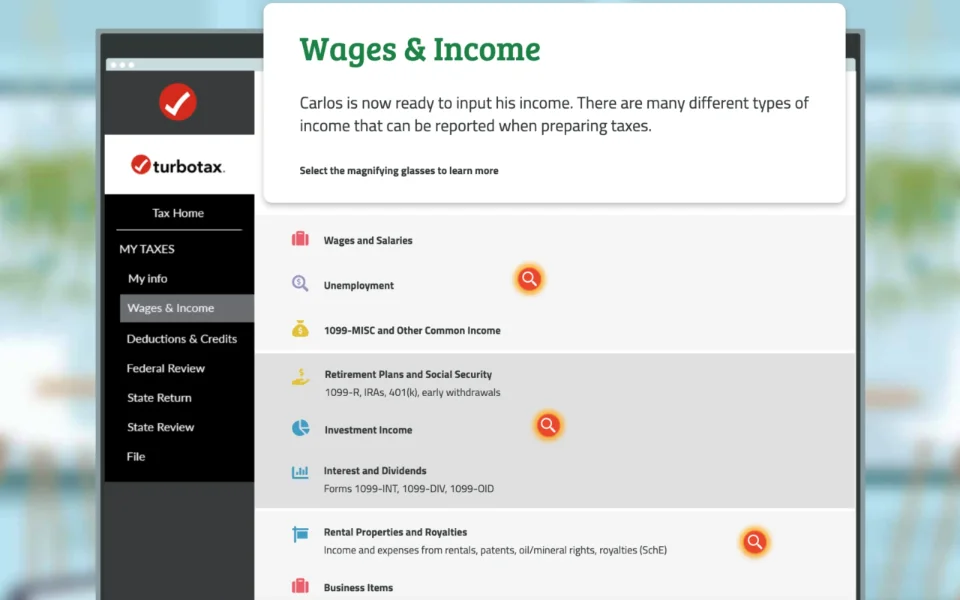

Students help a character file his taxes electronically and learn how online tax preparation software is helpful, secure, and effective.

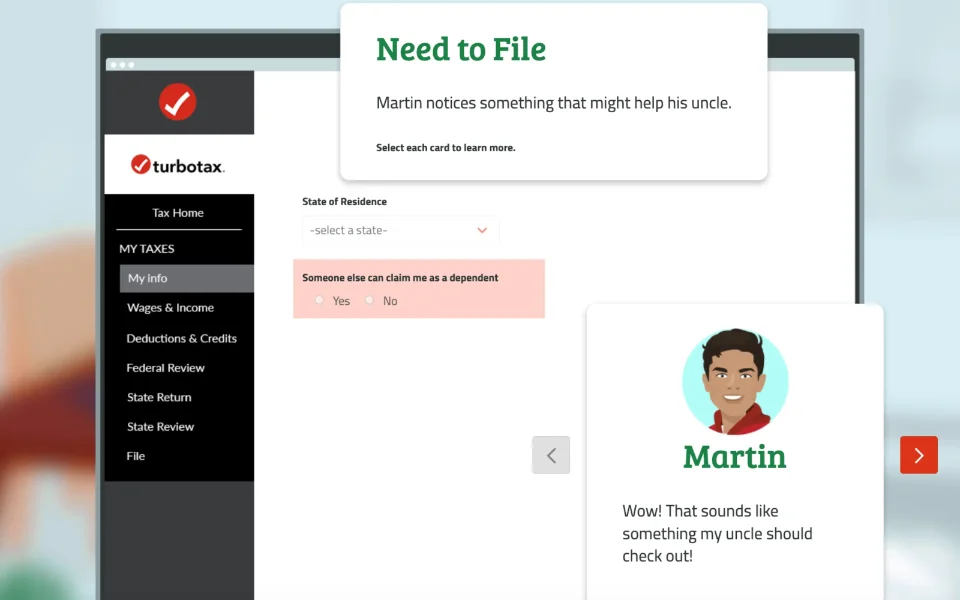

Students help a character claim more tax credits for his family through the Earned Income Tax Credit by better understanding who in his household can claim him as a dependent.

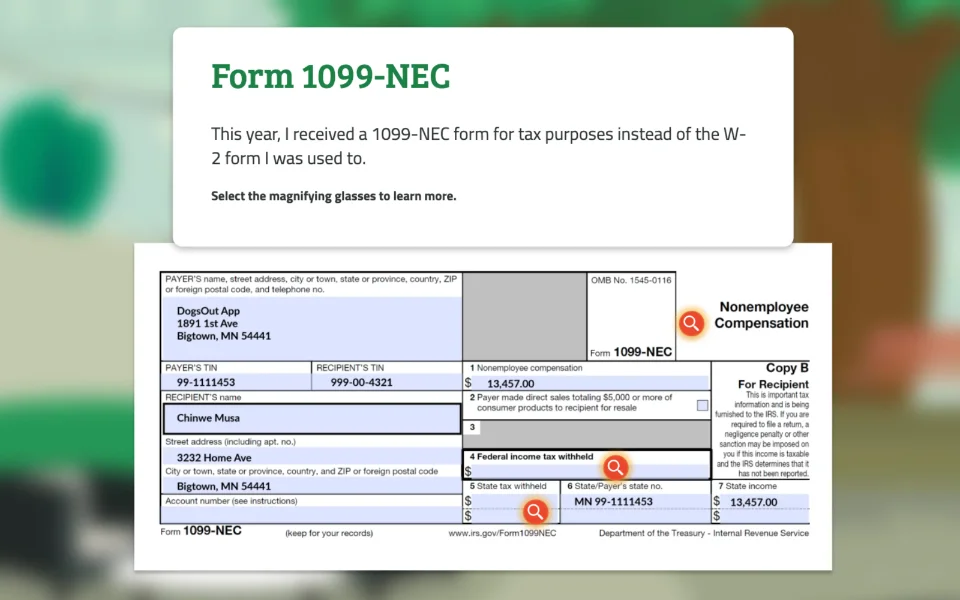

Students help a character manage her gig economy tax burden by filing her taxes using a 1099-NEC form and making estimated tax payments going forward.

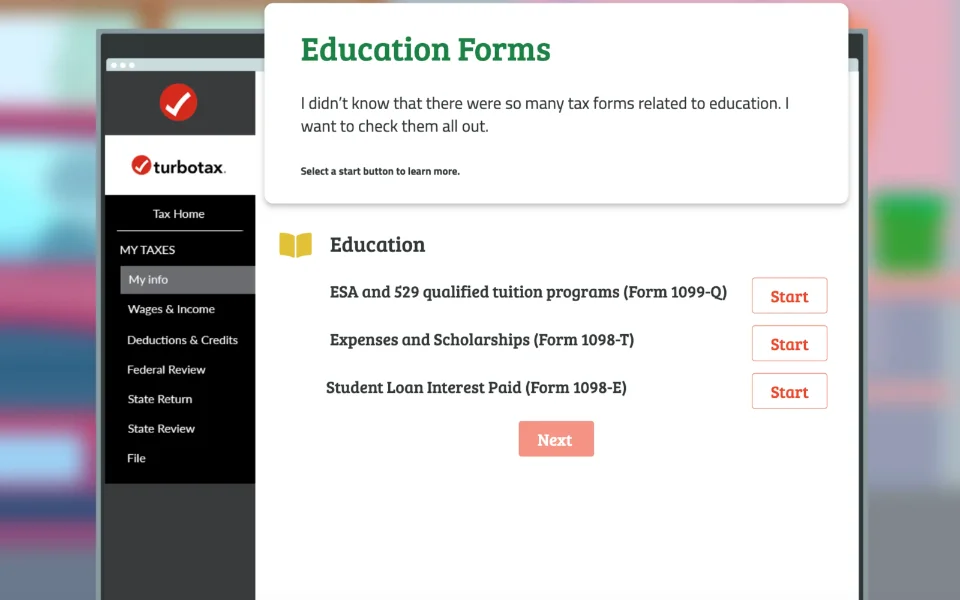

Students help a character navigate how to claim higher education expenses on her taxes and navigate the tax implications of 529 plan disbursements and interest on student loans.

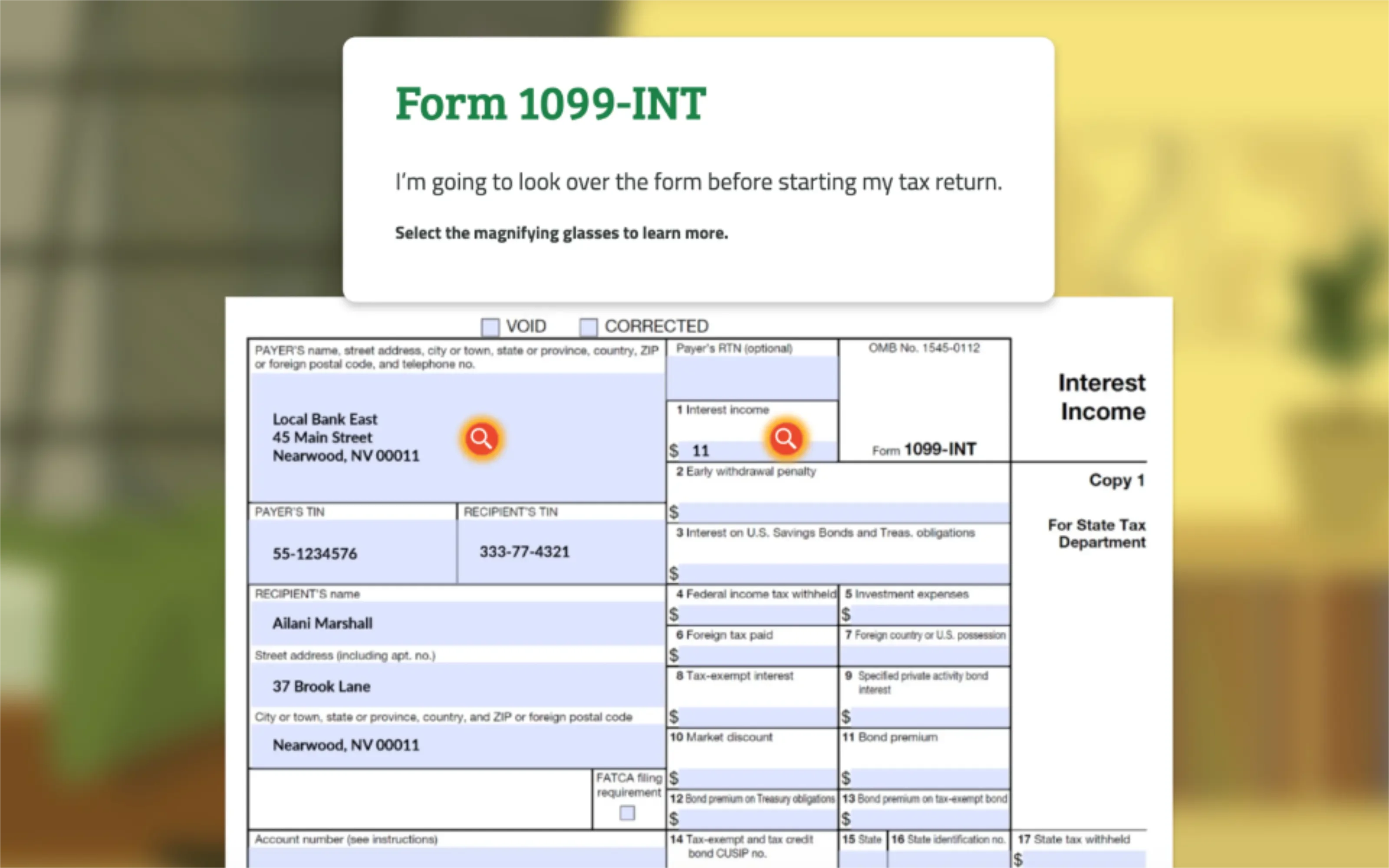

Students help a character learn how she needs to report interest from savings accounts and purchases of cryptocurrency for tax purposes.

-

Less than a third of high school juniors and seniors reported that they felt prepared to compare financial institutions and select one that best meets their needs (32%). Slightly more students — but still less than half (47%) — felt they could select, open, and manage a savings or checking account.

Young people also reported low levels of confidence in their ability to establish financial habits that contribute to long-term financial wellbeing: budgeting and managing credit. Half of juniors and seniors said they were “prepared” or “very prepared” to set up and follow a budget, while just a third (32%) felt they could check their credit and maintain good credit over time.

These skills budgeting and managing credit – are essential as young people move toward financial independence. The decisions they make in the next one to two years begin to carry consequences that can last much longer, directly impacting their lifetime financial wellbeing.

-

Yes, given the critical role of skill and confidence in building financial wellbeing, the low levels of preparedness among young people could be a sign of trouble as students finish high school and move toward financial independence.

-

Students learn the fundamentals of money management in financial literacy classes, including budgeting, saving, paying off debt, investing, and more. This information offers the groundwork for kids to establish sound financial practices at a young age and steer clear of many mistakes that result in ongoing financial difficulties.

Why Everfi?

Everfi empowers educators to bring real-world learning into the classroom and equip students with the skills they need for success-now and in the future. Our curriculum and courses are:

- Loved by 750,000+ teachers

- Aligned to US, Canada, and UK learning standards.

- Real-world lessons that are self-paced and interactive.

- Automatically graded with built-in assessments and reporting.

- Extendable with activities and resources to bring the information to life.

- Supported with a dedicated, regional team.

- Forever free for K-12 educators.

How Are These Lessons Free?

Thanks to the generous sponsorship of corporations who share our mission, Everfi’s courses are completely free to teachers, districts, and families

This course is made possible through partnerships with community-focused financial institutions who invest in student financial literacy. That’s why everything—curriculum, training, and support—is completely free to educators.