Financial Literacy & Financial Education for K-12 Students

Prepare students for their financial future

Give students the financial skills they’re asking for—without adding to your workload. Our standards-aligned curriculum is designed by educators, for educators, with turnkey lessons that fit seamlessly into your existing plans. Everything is completely free to K-12 educators, funded by our community business partners.

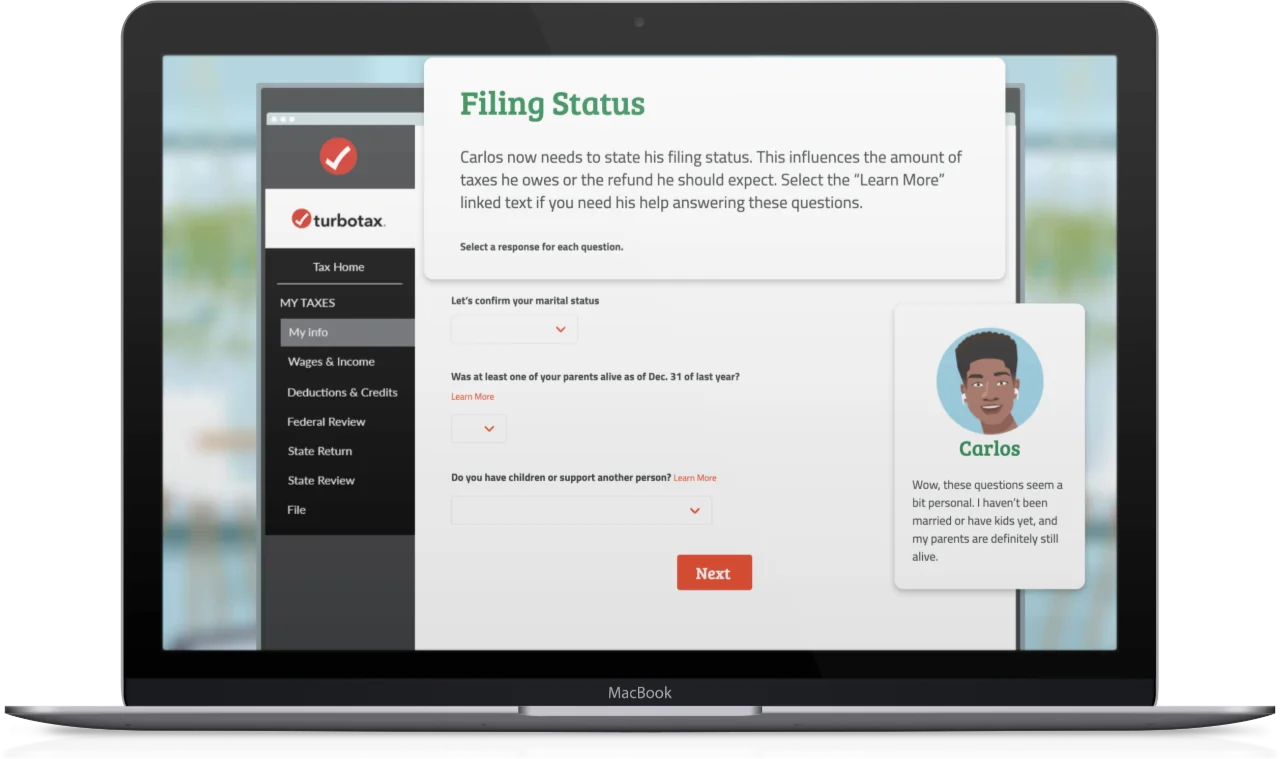

Tax Simulation: Understanding Taxes | Free Tax Course for High School Students

Grade Levels

9th, 10th, 11th, 12th

Description

This financial education course, sponsored by Intuit for Education, helps students develop healthy financial habits and build confidence about handling their taxes. Through a high-fidelity experience of navigating tax preparation software, students are introduced to important and relevant tax considerations. To enhance the learning experience, several videos are going to be featured in the course this summer covering topics like summarizing a 1099 form and calculating tax requirements.

Financial Literacy for High School Students | Free Course

Grade Levels

9th, 10th, 11th, 12th

Description

Everfi’s free high school financial literacy course equips students with tools to manage their personal finances in the real world, from applying for financial aid to establishing credit and investing. Available in Spanish.

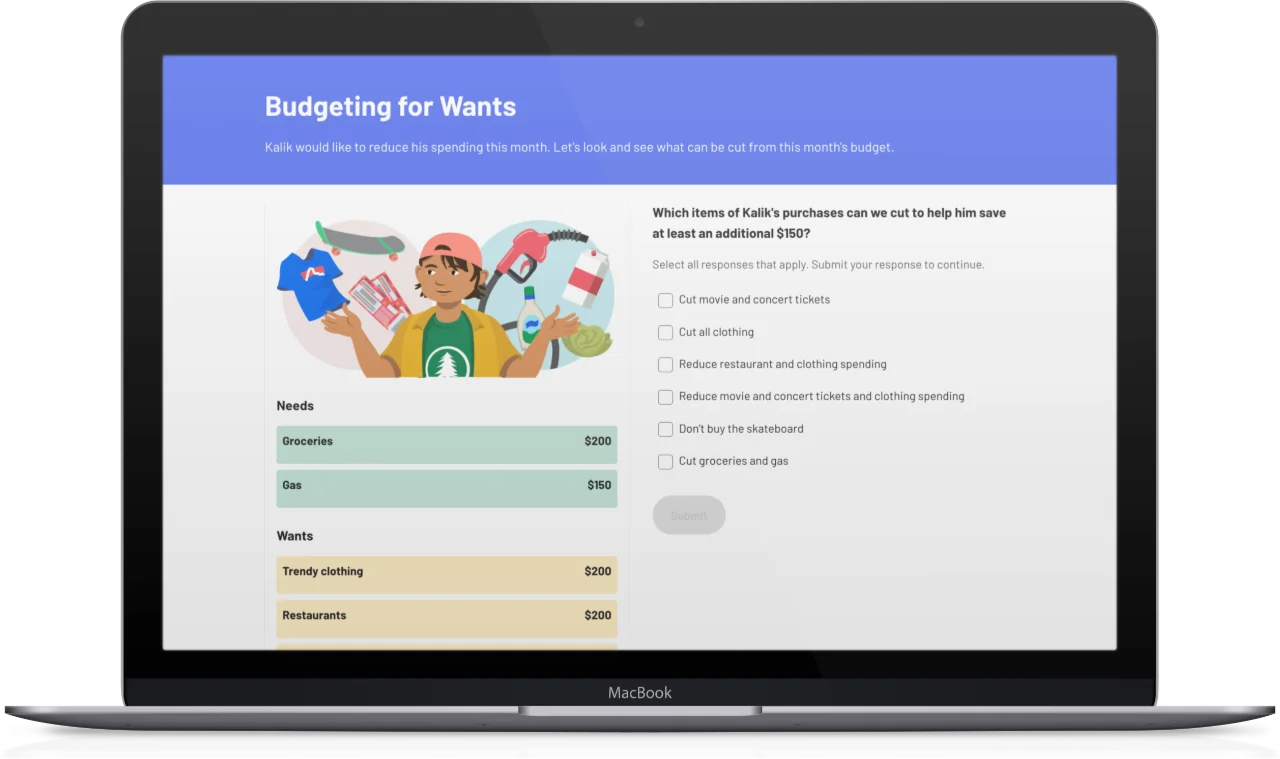

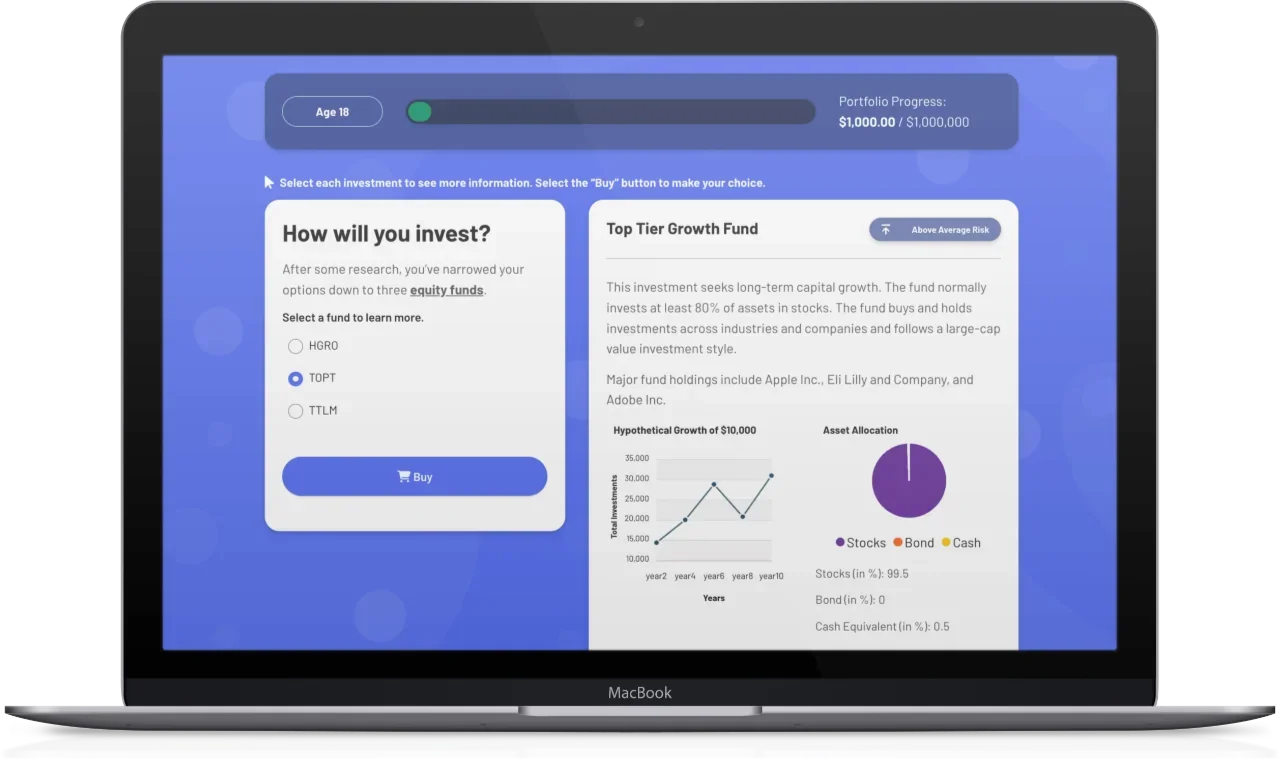

Marketplaces: Investing Basics | Free Investment Course for High School Students

Grade Levels

9th, 10th, 11th, 12th

Description

In Marketplaces, students learn basic investment concepts that are needed to intelligently and confidently participate in the financial markets.

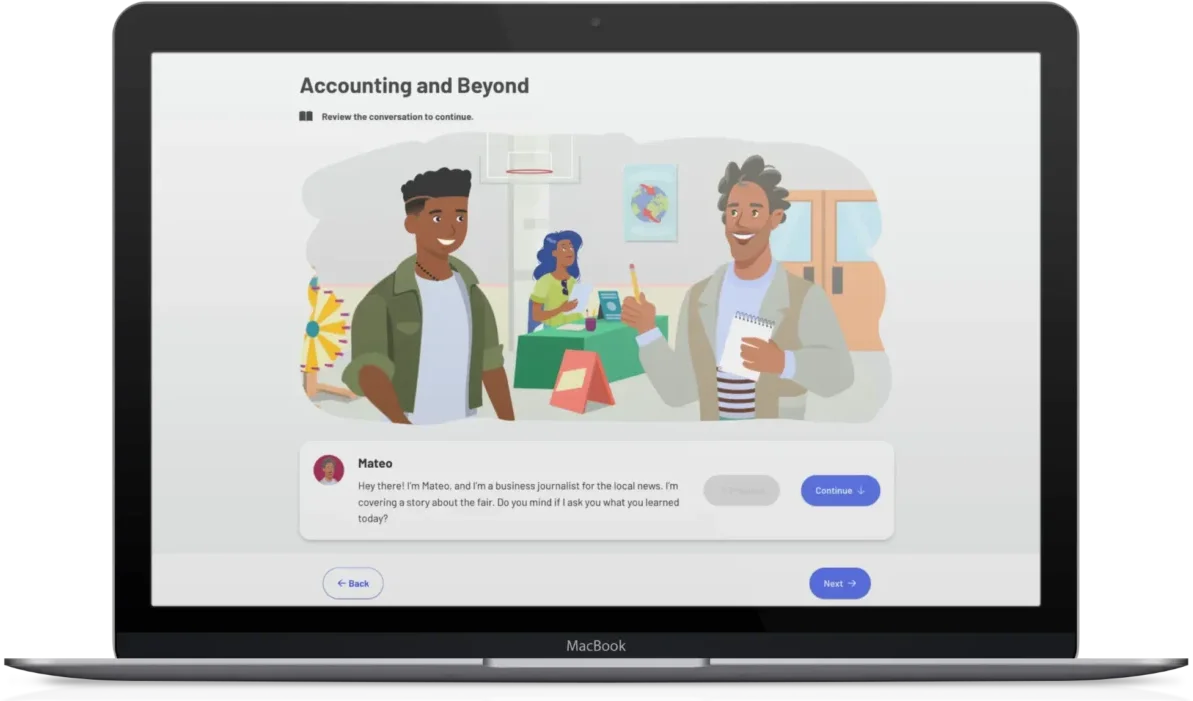

Accounting Careers: Limitless Opportunities

Grade Levels

9th, 10th, 11th, 12th

Description

This free digital course, sponsored by the Center for Audit Quality’s Accounting+ program, exposes students to the wide range of careers available in the accounting and finance space

Data Science Foundations and Exploration Lab

Grade Levels

9th, 10th, 11th, 12th

Description

Data Science Foundations is designed to empower students with knowledge about the fundamentals of data science, its currency in the job market, and its applicability to everyday life. Available in Spanish.

Minding Your Money: Skills for Life

Grade Levels

9th, 10th, 11th, 12th

Description

Minding Your Money: Skills for Life is a free digital financial education course that teaches students about different financial stages in life, how money and mental health are intertwined, and how money can affect interpersonal relationships.

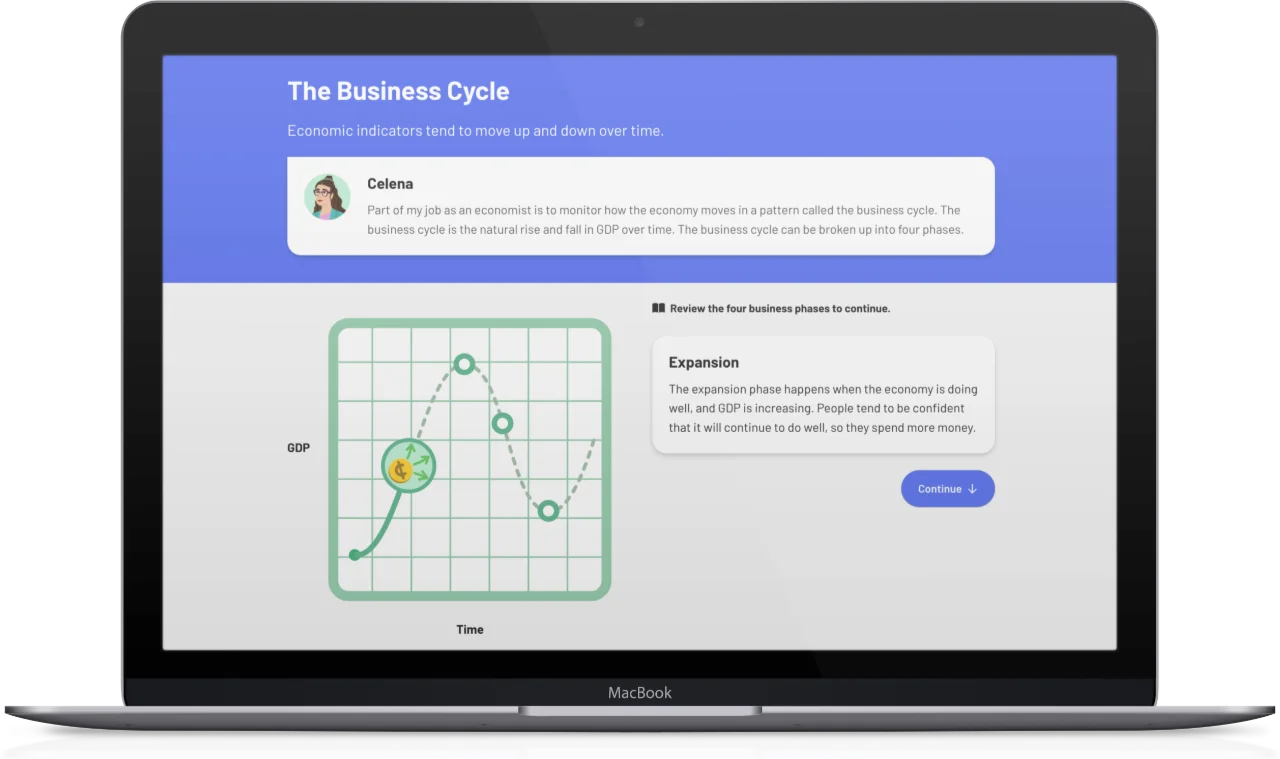

Econ Foundations: Economics for High School

Grade Levels

9th, 10th, 11th, 12th

Description

This new financial education course brings macroeconomic concepts to life for students through interactive, real-world scenarios. Students explore how the economy impacts individuals and businesses, evaluate the health of the economy using economic indicators, analyze how the government and Central Bank use economic policy to regulate the business cycle, and predict how individuals and businesses will behave in a growing or declining economy.

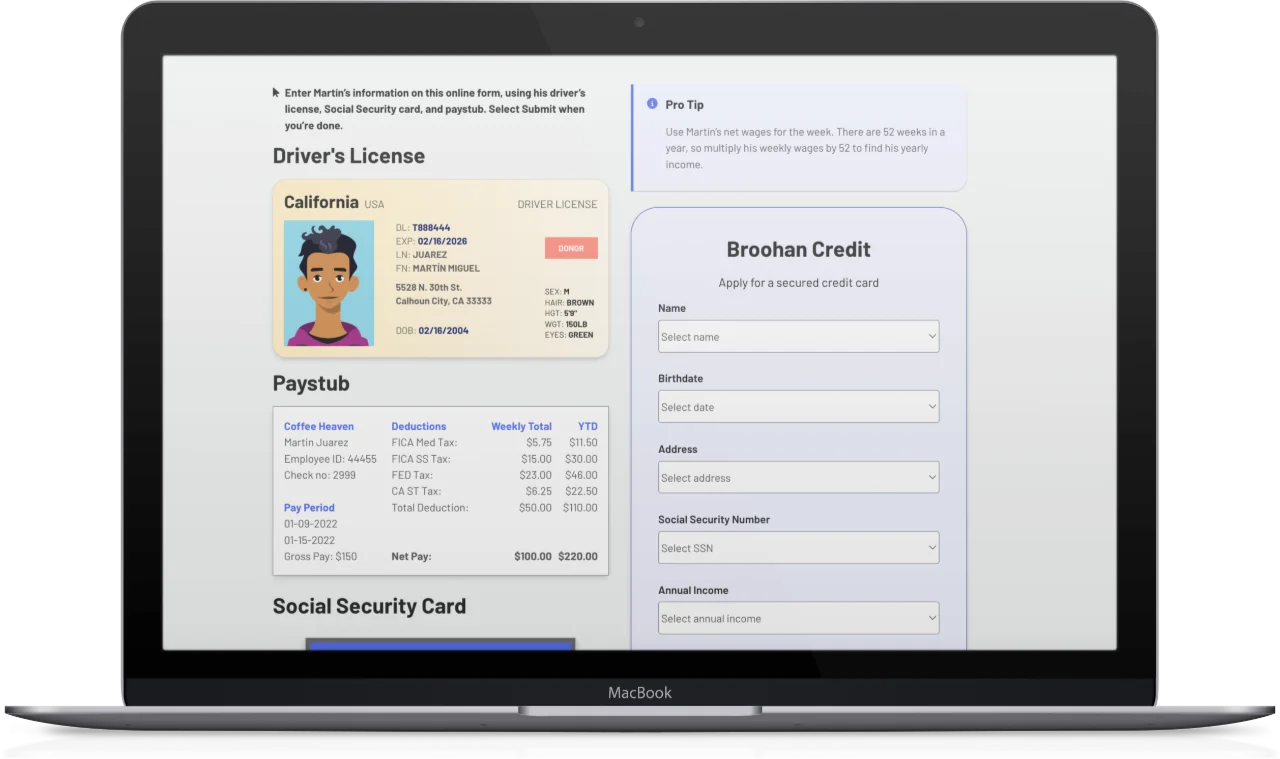

Build: Credit Fundamentals

Grade Levels

9th, 10th, 11th, 12th

Description

This financial education course teaches students the fundamentals of managing a healthy credit score. The course outlines what good credit is and its long-term effects on a person’s financial life. Through real-world scenarios, students learn to make wise decisions that support their current and future financial well-being. The course also enables students to identify inaccuracies on credit reports and deal with them effectively.

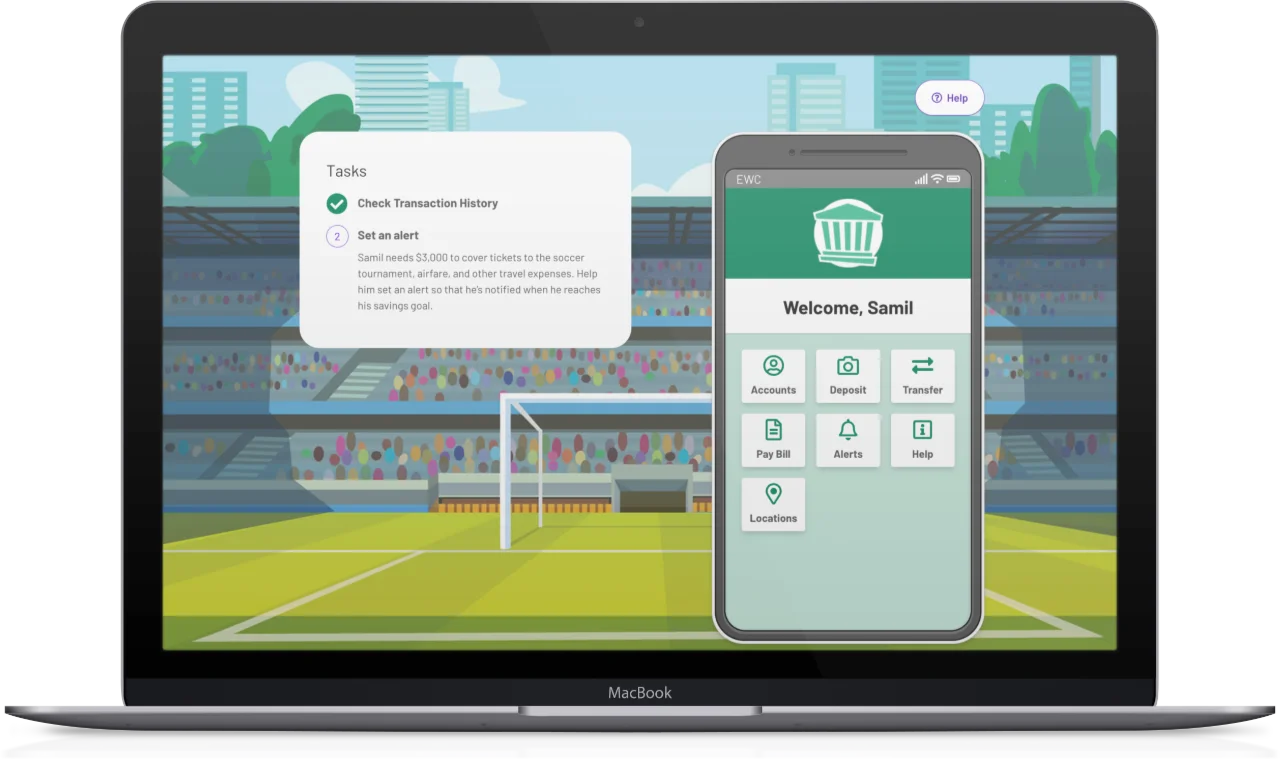

Modern Money: Safe Digital Banking

Grade Levels

9th, 10th, 11th, 12th

Description

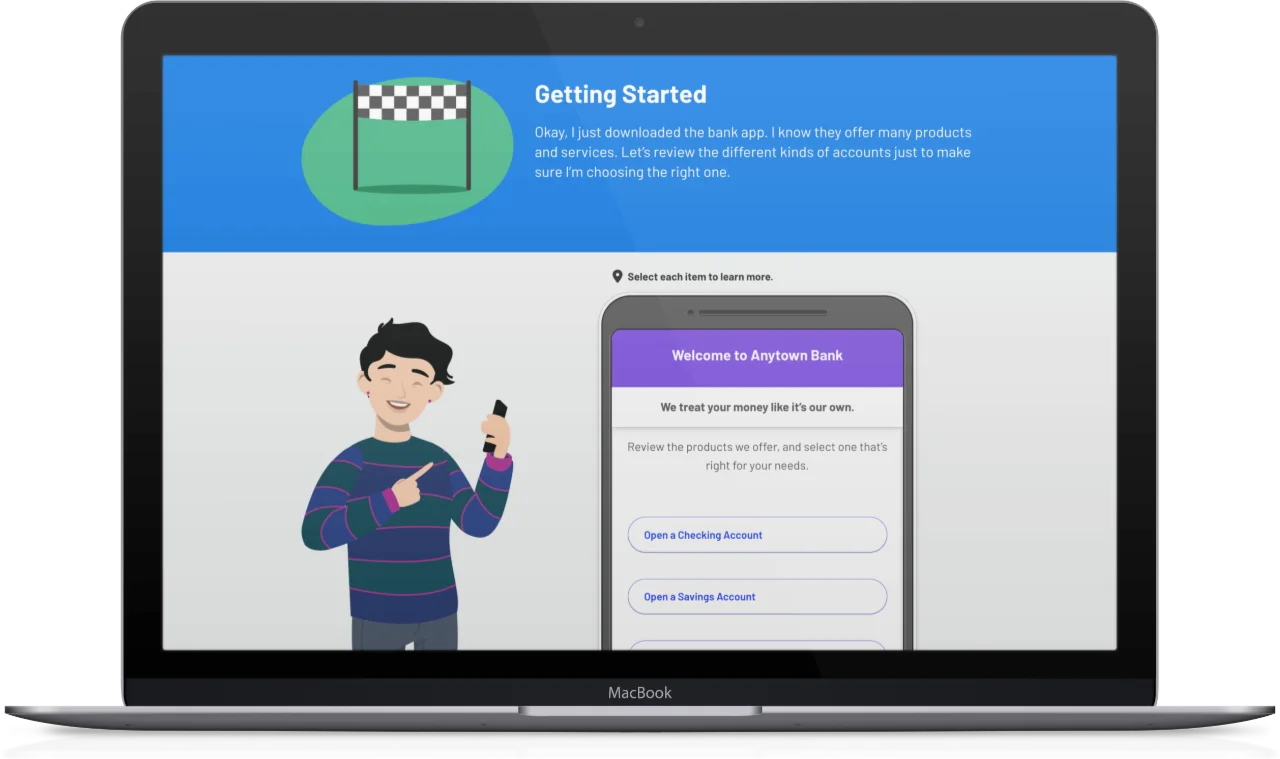

This financial education course provides students with the knowledge and skills to make wise decisions that promote financial wellbeing. Through interactive real-world scenarios, students learn strategies to manage their finances, how to safely and responsibly use banking tools, and methods to recognize and avoid scams and fraud. The course is designed to create more confident, financially savvy high schoolers that are prepared for adulthood.

Everfi Pathways: Financing Higher Education

Grade Levels

9th, 10th, 11th, 12th

Description

Pathways develops informed consumers, preparing students to make wise financial decisions when considering how to best finance their higher education and pay for college. Students learn about topics like financial aid, applying for FAFSA, student loans, and budgeting for responsible loan repayment. Available in Spanish.

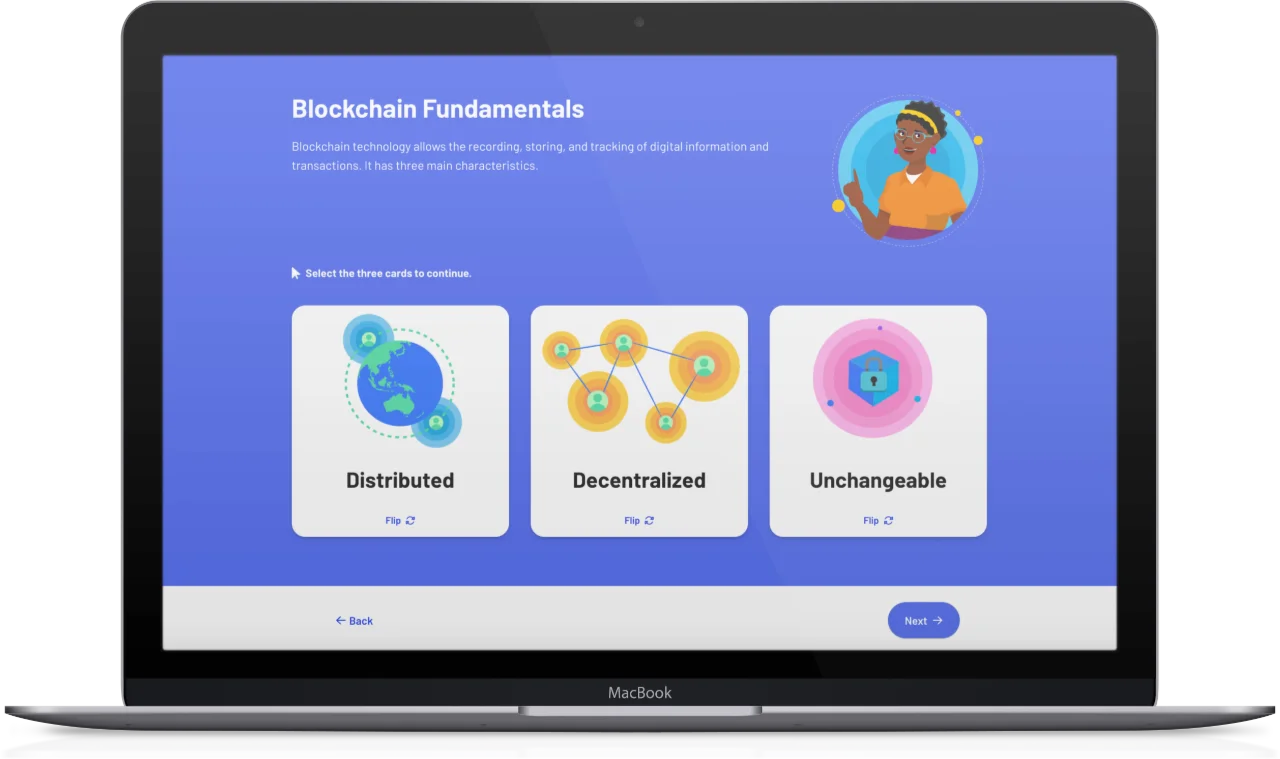

Crypto Foundations

Grade Levels

9th, 10th, 11th, 12th

Description

Crypto Foundations is a digital program that teaches high school students what cryptocurrency is, how it’s created on the blockchain and the risks and benefits of holding cryptocurrencies as an investment.

Grow: Financial Planning for Life

Grade Levels

9th, 10th, 11th, 12th

Description

Grow: Financial Planning for Life is a digital program that helps teach students how to make wise financial decisions to promote financial well-being over their lifetime. Available in Spanish.

Venture: Entrepreneurial Expedition | Free Online Course

Grade Levels

9th, 10th, 11th, 12th

Description

Students start their own food truck business, and learn to write a business plan, hire a team, hone their pitch, and balance a budget in the process.

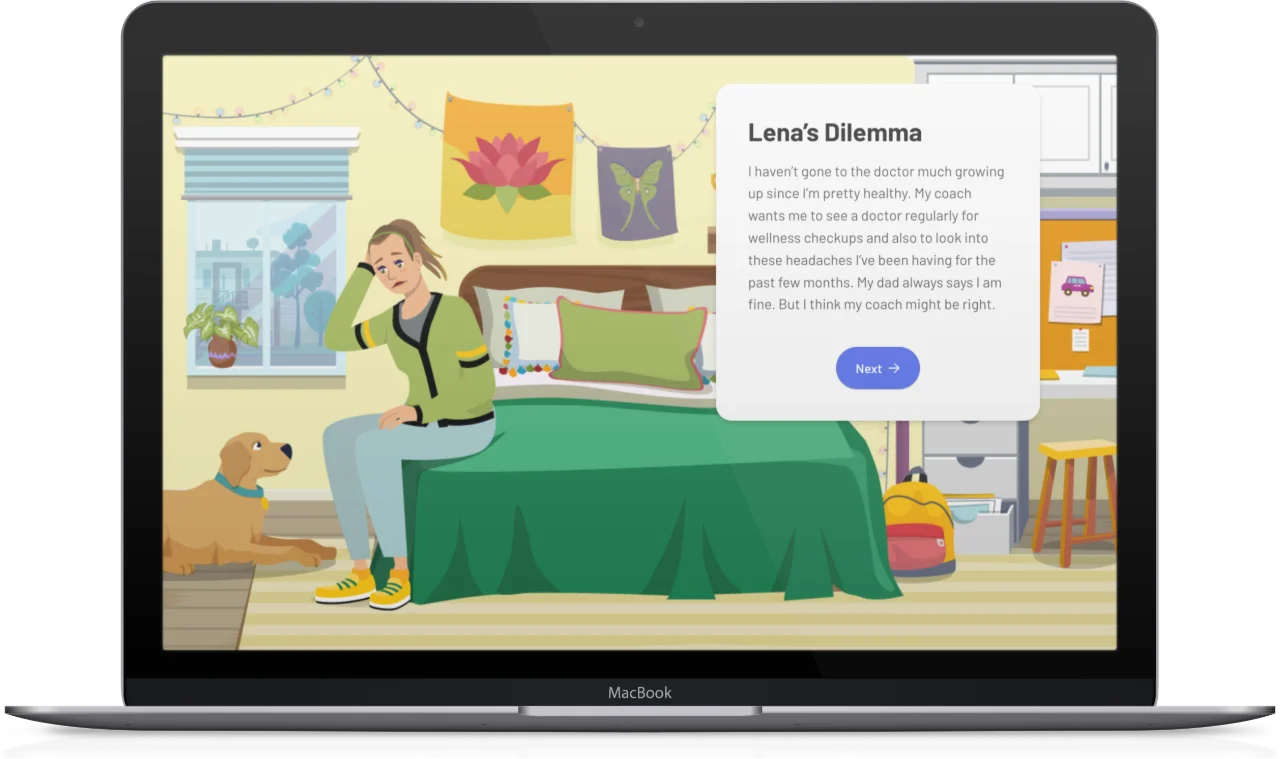

Health Literacy Curriculum for High School

Grade Levels

9th, 10th, 11th, 12th

Description

Everfi’s Health Literacy Curriculum empowers students to become advocates for their own health and financial wellness, helping them understand when and where to ask for help when making health care decisions. Available in Spanish.

Start Exploring Digital Lessons

Register for Everfi’s free learning platform–used by more than 45,000 educators last school year alone.

FutureSmart: Financial Literacy | Free Financial Literacy Course for Middle School Students

Grade Levels

6th, 7th, 8th

Description

In FutureSmart, middle school students act as mayor of their town, helping citizens solve the financial problems life throws their way. Available in Spanish.

SmartEconomics: Economics for Middle School

Grade Levels

6th, 7th, 8th

Description

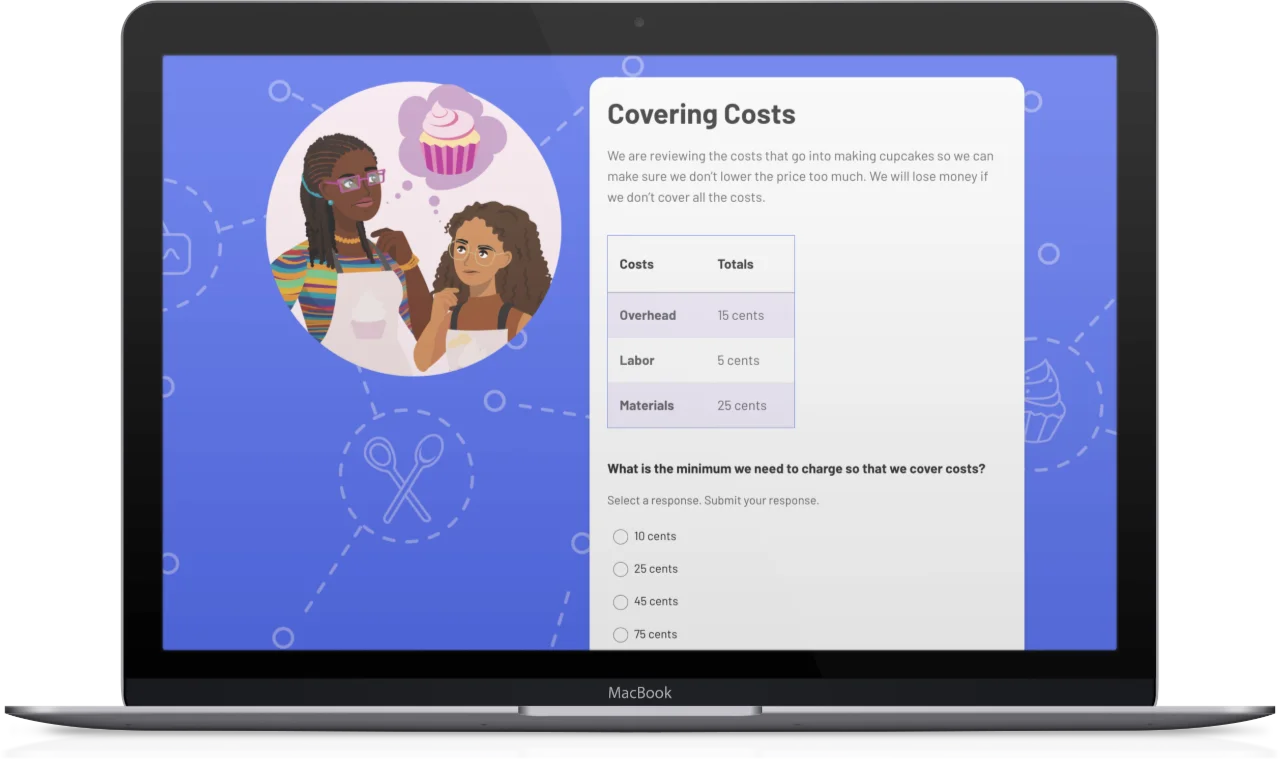

SmartEconomics is a digital course that empowers middle school students to analyze the economy and identify factors that impact the price of consumer goods. Available in Spanish.

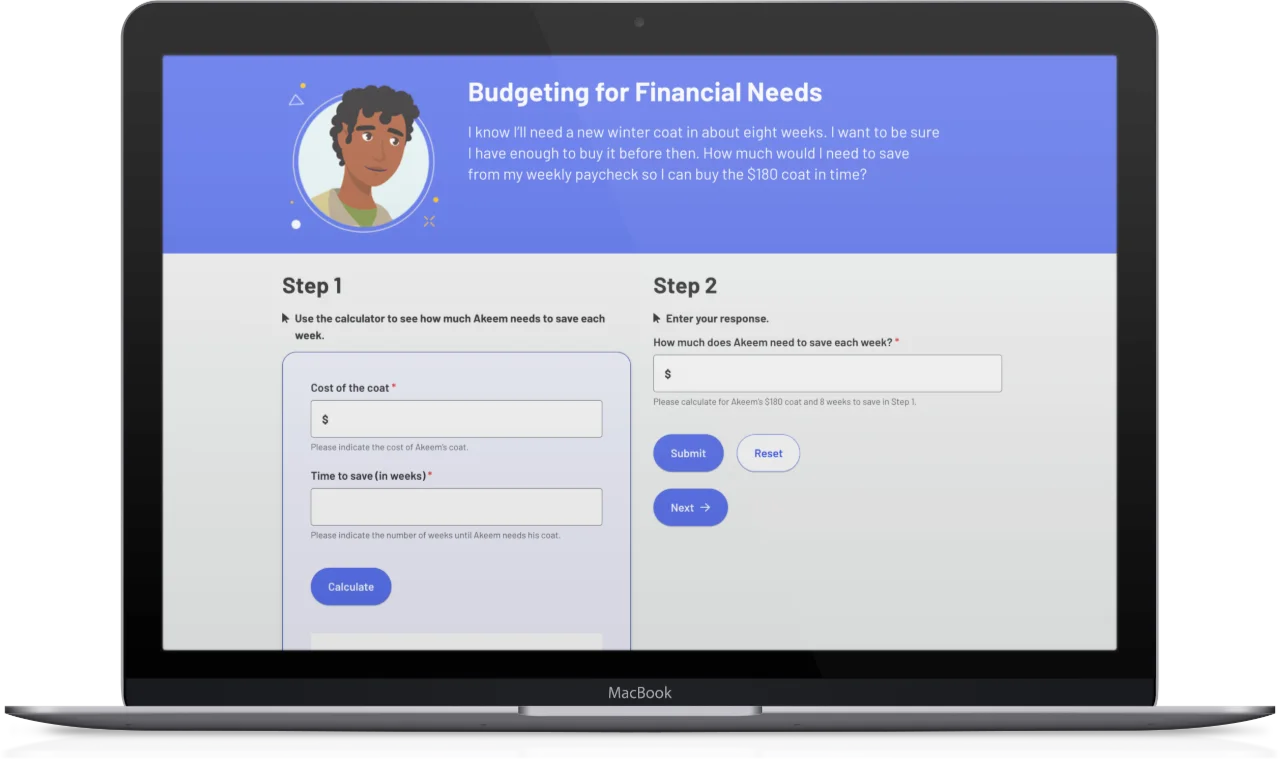

SaveUp: Saving Money for the Future

Grade Levels

6th, 7th, 8th

Description

In SaveUp, middle school students develop strategies for budgeting, emergency planning, saving and setting smart financial goals. Available in Spanish.

Vault: Understanding Money

Grade Levels

4th, 5th, 6th

Description

Students dive into a virtual world to learn the basic ins-and-outs of finances. Can you help a friend from space learn the difference between needs and wants? Available in Spanish and French.

Venture: Entrepreneurial Expedition | Free Online Course

Grade Levels

7th, 8th, 9th, 10th

Description

Students start their own food truck business, and learn to write a business plan, hire a team, hone their pitch, and balance a budget in the process.

Always Free

Everfi’s K-12 Resources Are Available at No Cost to Teachers, Schools, and Districts

Vault: Understanding Money

Grade Levels

4th, 5th, 6th

Description

Students dive into a virtual world to learn the basic ins-and-outs of finances. Can you help a friend from space learn the difference between needs and wants? Available in Spanish and French.

Want to bring financial education to your community?

-

Check out our Getting Started with Everfi document which has downloadable guides for educators and students to guide you through our quick and easy setup process. Additionally, here’s more detail on the entire financial education suite of courses currently available on our platform for students in grades 4-12.

-

After you have created your classes, use these student quick start guides (opens in new tab) to grant students access (see page 2 on the guide for SSO directions).

-

Yes! All our financial literacy courses are aligned with National Jump$tart Standards for K-12 Personal Finance Education. You can view standards alignment for a particular course by creating an account and clicking “Details” for the course. For a state specific standard alignment guide, you can reach out to our support team ([email protected]).

-

Our Teacher Resource center includes articles and videos that review platform navigation steps such as how to create classes and how to register students (you can access these resources directly through your dashboard by clicking on the blue question mark in the bottom left corner). You can also reach out to our dedicated support team ([email protected]) for answers to any questions or book a demo.

-

Our courses can be used in a variety of ways! Lessons are completely planned for you and designed for students to move through independently, so the delivery method is highly adaptable. Use lessons to introduce or review key topics, in small groups for a station activity, as a homework assignment, for an extension opportunity, or as a replacement for a chapter in a textbook. Our courses also include offline lesson plans and additional resources as an optional extension to the digital courses. For personalized implementation suggestions, book a demo with our support team.

-

Yes! We have SSO log in and roster integration through Clever and ClassLink. You can review Clever and ClassLink registration steps here or reach out to our support team ([email protected]) if you would like to have Everfi added to your SSO portal. We also have SSO log in through Google but do not directly integrate with Google Classroom.

-

Check system requirements here by selecting the device tab. Then find the list of K-12 education courses that are supported on a particular device.

-

Organizations can sponsor Everfi’s financial education courses to make a meaningful impact in local schools or across broader regions. Sponsorship helps bring these critical learning resources to students at no cost to them or their schools. Learn more about launching a sponsorship program here: everfi.com/financial-education.

-

Please visit our general FAQ’s page.

Interactive Lessons

Standards-aligned educational content that captures student interest and supports teacher priorities.

Measurable Impact

Monitor student progress with built-in assessments and automatic grading to save teachers’ time.

Implementation Support

Our regional team guides teachers every step of the way–from free trainings to professional learning events.