K-12 FINANCIAL EDUCATION

Financial Literacy & Financial Education for K-12 Students

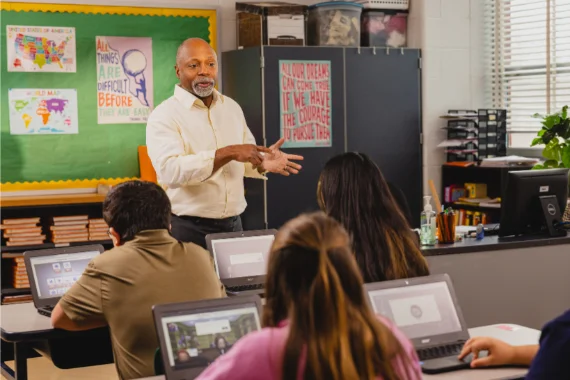

Prepare students for their financial future

Financial education is more than dollars and cents. It’s about establishing better spending habits, instilling confidence, and equipping the next generation with the real-world skills to manage financial goals and milestones.

EVERFI’s online financial education curriculum, training, and support are completely free to K-12 educators.

Download your free Financial Literacy Toolkit today

Financial Education for High School Students

According to a 2024 Intuit survey¹ , 85% of American high school students say that they are interested in learning more about financial topics in school. The need for financial literacy programs is undeniable. As of summer 2024, twenty-six U.S. states require financial education for high school students to graduate; many more have bills pending.

Financial Education for Middle School Students

Financial Education for Elementary School Students

Financial Literacy Education FAQ

Check out our Getting Started with EVERFI document which has downloadable guides for educators and students to guide you through our quick and easy setup process. Additionally, here’s more detail on the entire financial education suite of courses currently available on our platform for students in grades 4-12.

After you have created your classes, use these student quick start guides to grant students access (see page 2 on the guide for SSO directions).

Yes! All of our Financial Literacy courses are aligned with National Jump$tart Standards for K-12 Personal Finance Education. You can view standards alignment for a particular course by creating an account and clicking “Details” for the course. For a state specific standard alignment guide, you can reach out to our support team ([email protected]).

Our Teacher Resource center includes articles and videos that review platform navigation steps such as how to create classes and how to register students (you can access these resources directly through your dashboard by clicking on the blue question mark in the bottom left corner). You can also reach out to our dedicated support team ([email protected]) for answers to any questions or book a demo.

Our courses can be used in a variety of ways! Lessons are completely planned for you and designed for students to move through independently, so the delivery method is highly adaptable. Use lessons to introduce or review key topics, in small groups for a station activity, as a homework assignment, for an extension opportunity, or as a replacement for a chapter in a textbook. Our courses also include offline lesson plans and additional resources as an optional extension to the digital courses. For personalized implementation suggestions, book a demo with our support team.

Yes! We have SSO log in and roster integration through Clever and ClassLink. You can review Clever and ClassLink registration steps here or reach out to our support team ([email protected]) if you would like to have EVERFI added to your SSO portal. We also have SSO log in through Google but do not directly integrate with Google Classroom.

Check system requirements here by selecting the device tab. Then find the list of K12 education courses that are supported on a particular device.

Organizations can sponsor EVERFI’s financial education programs to make a meaningful impact in local schools or across broader regions. Sponsorship helps bring these critical learning resources to students at no cost to them or their schools. Learn more about launching a sponsorship program here: everfi.com/financial-education

Please visit our general FAQ’s page.

Comprehensive, Digital Financial Literacy

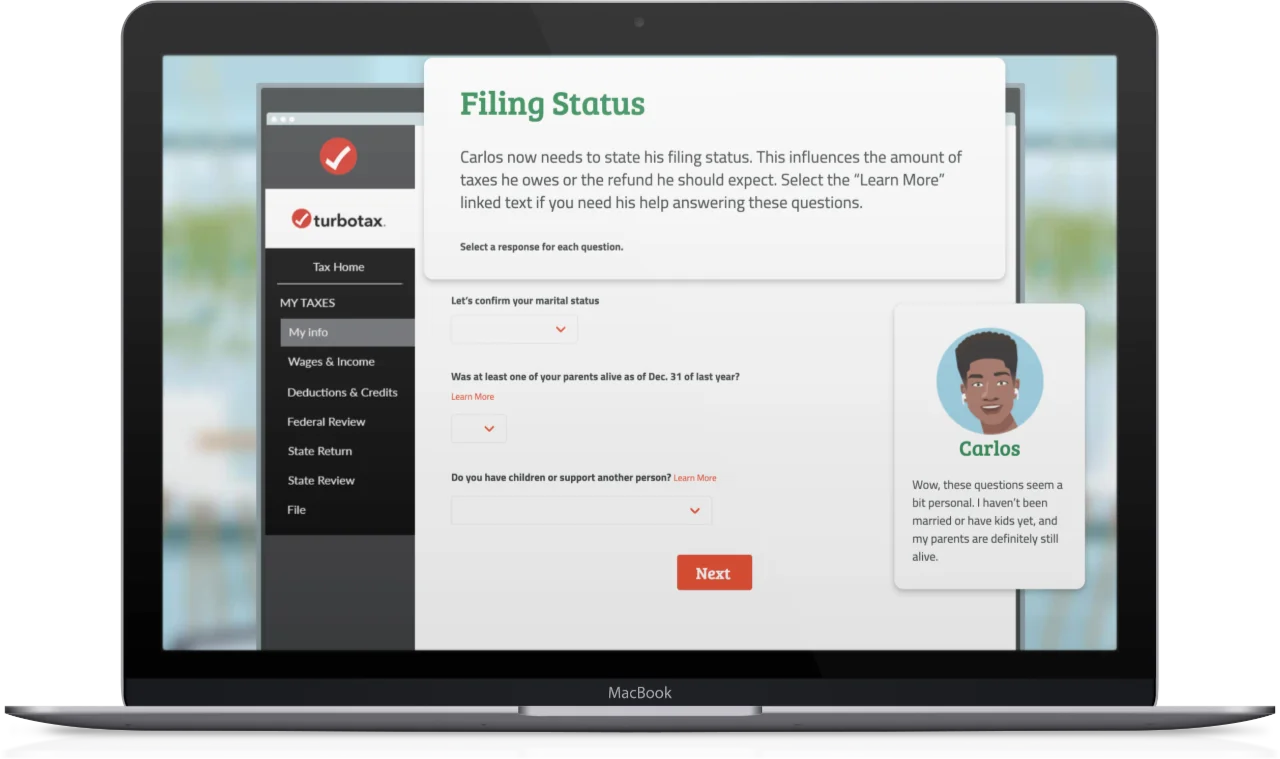

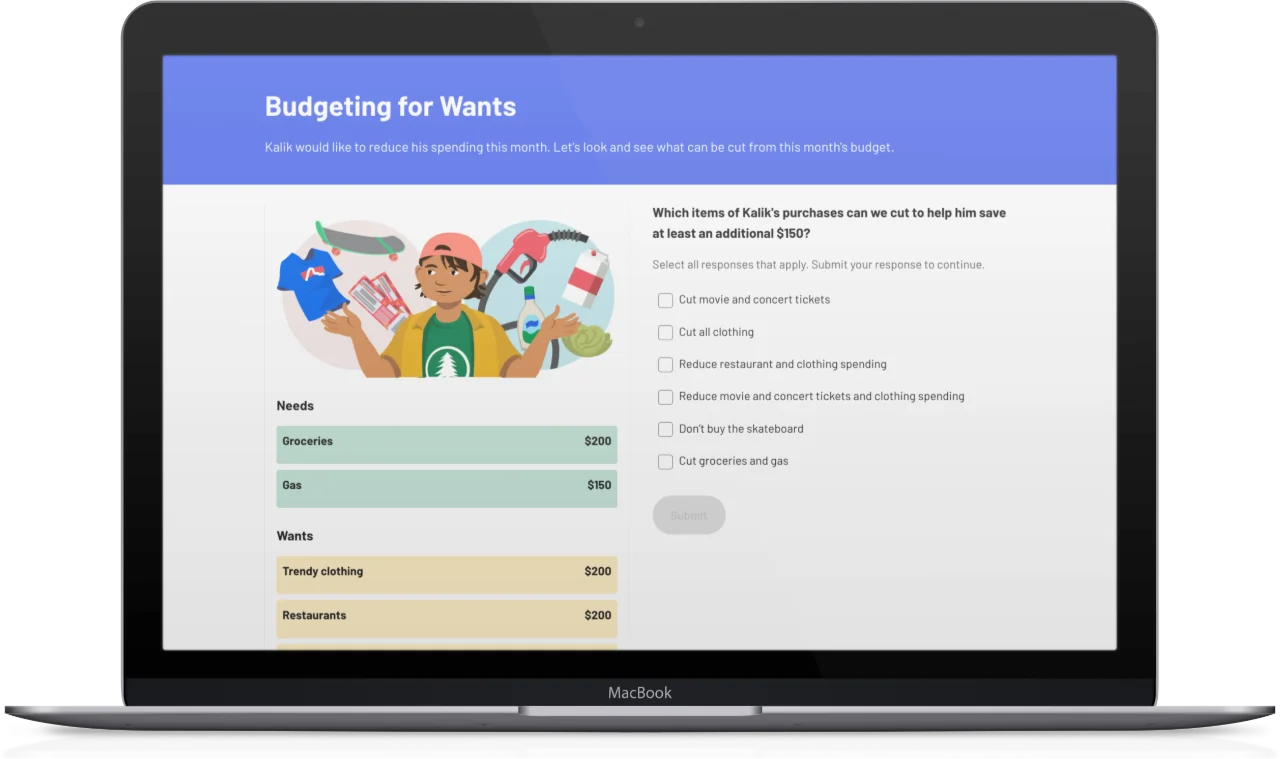

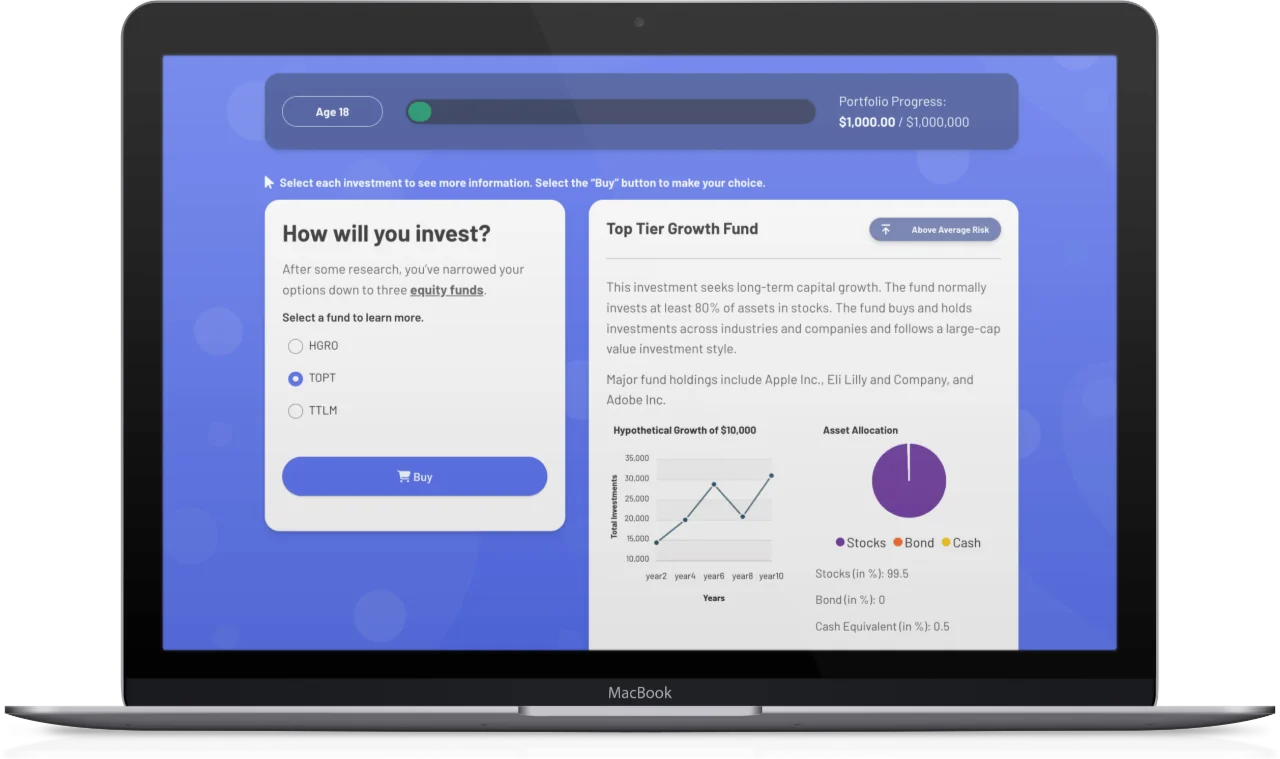

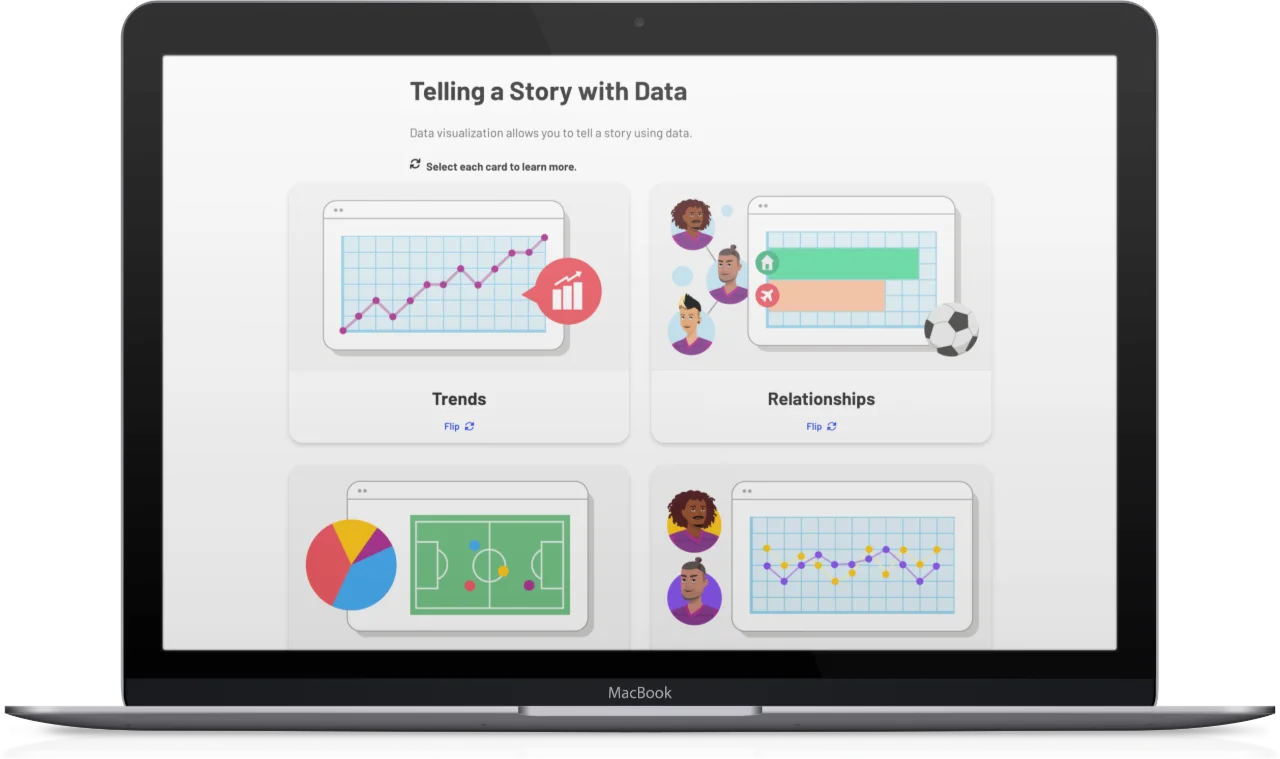

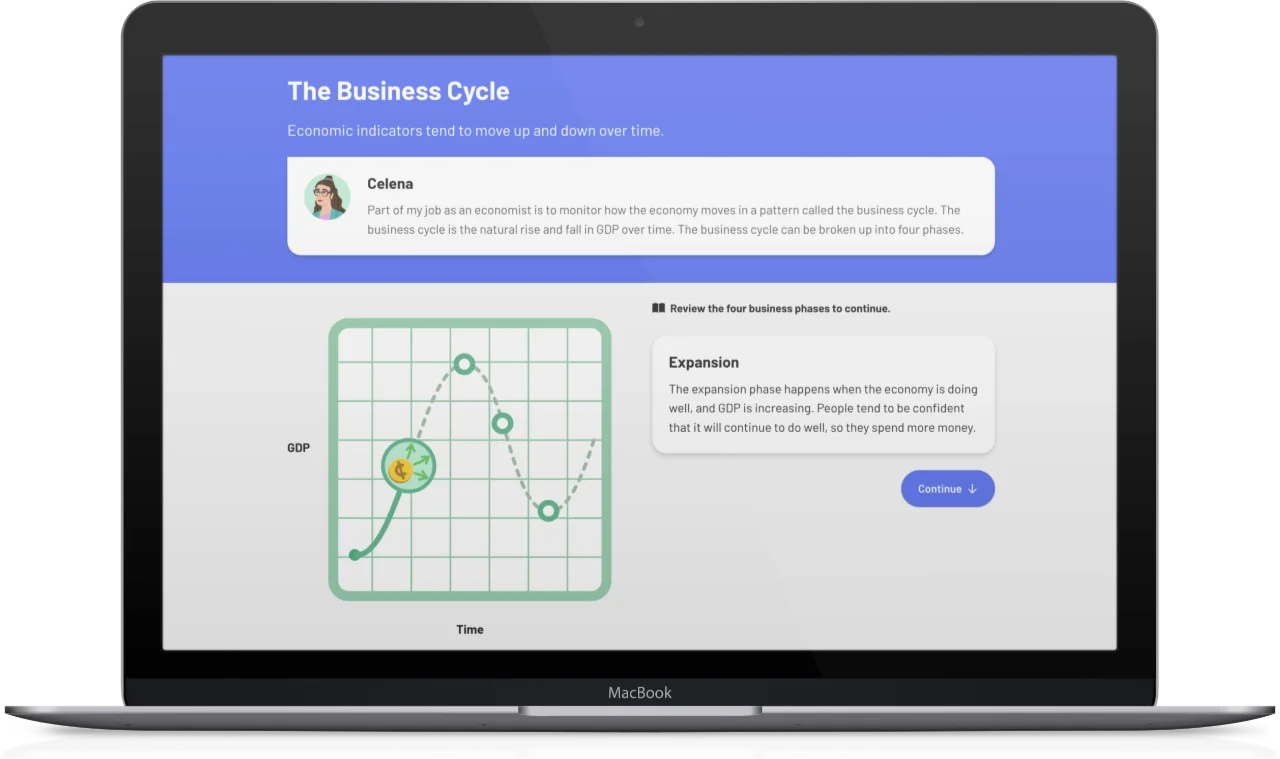

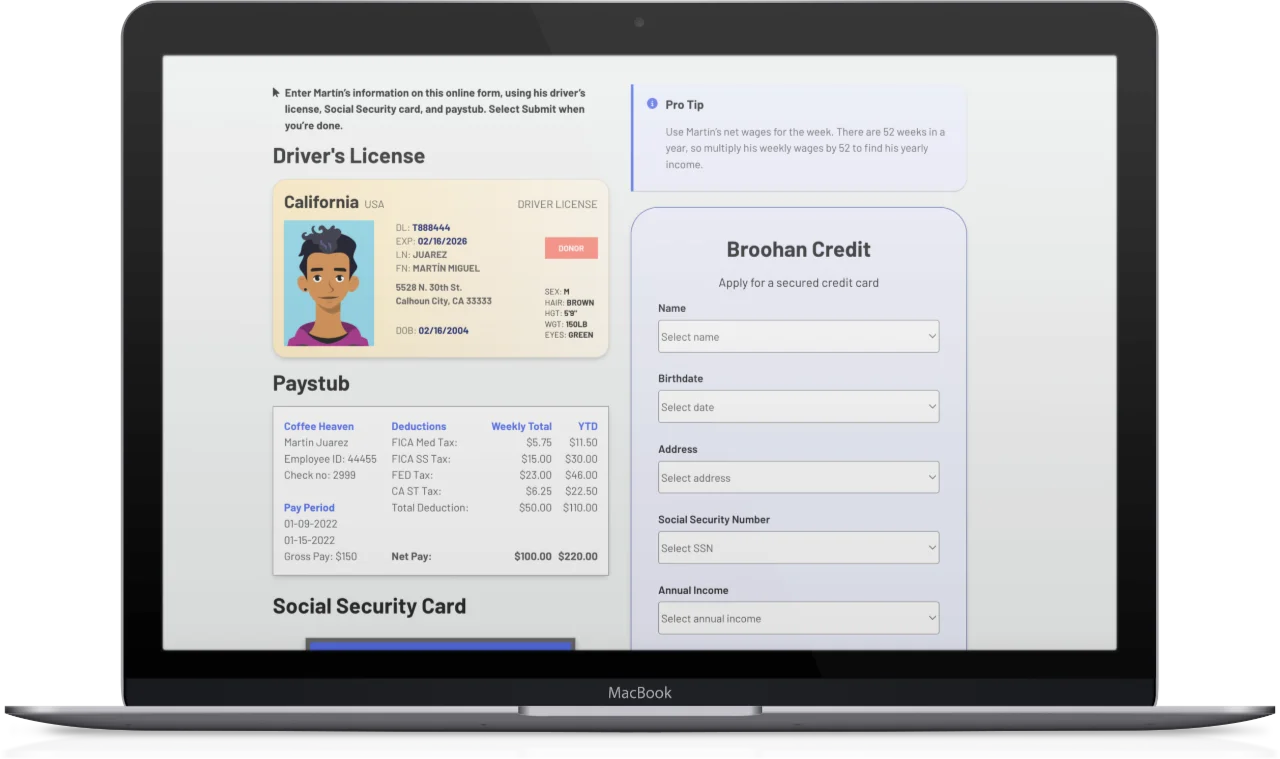

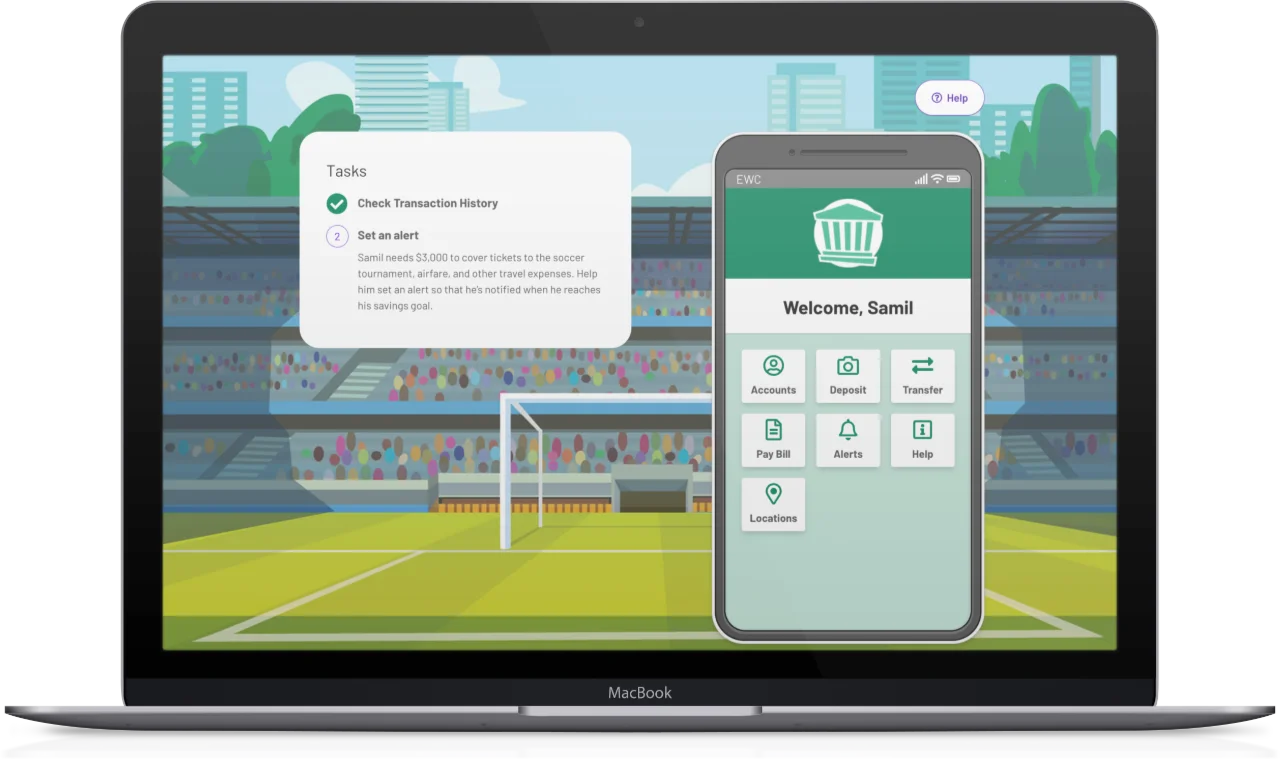

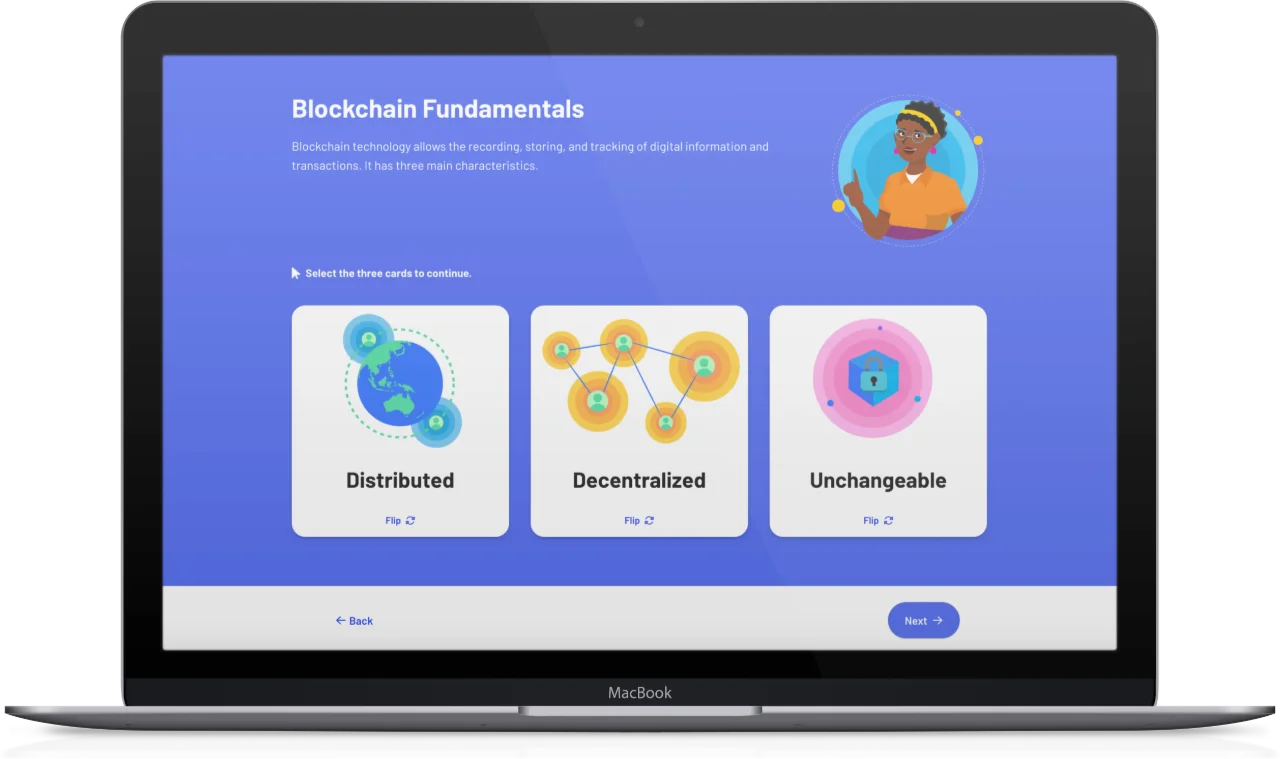

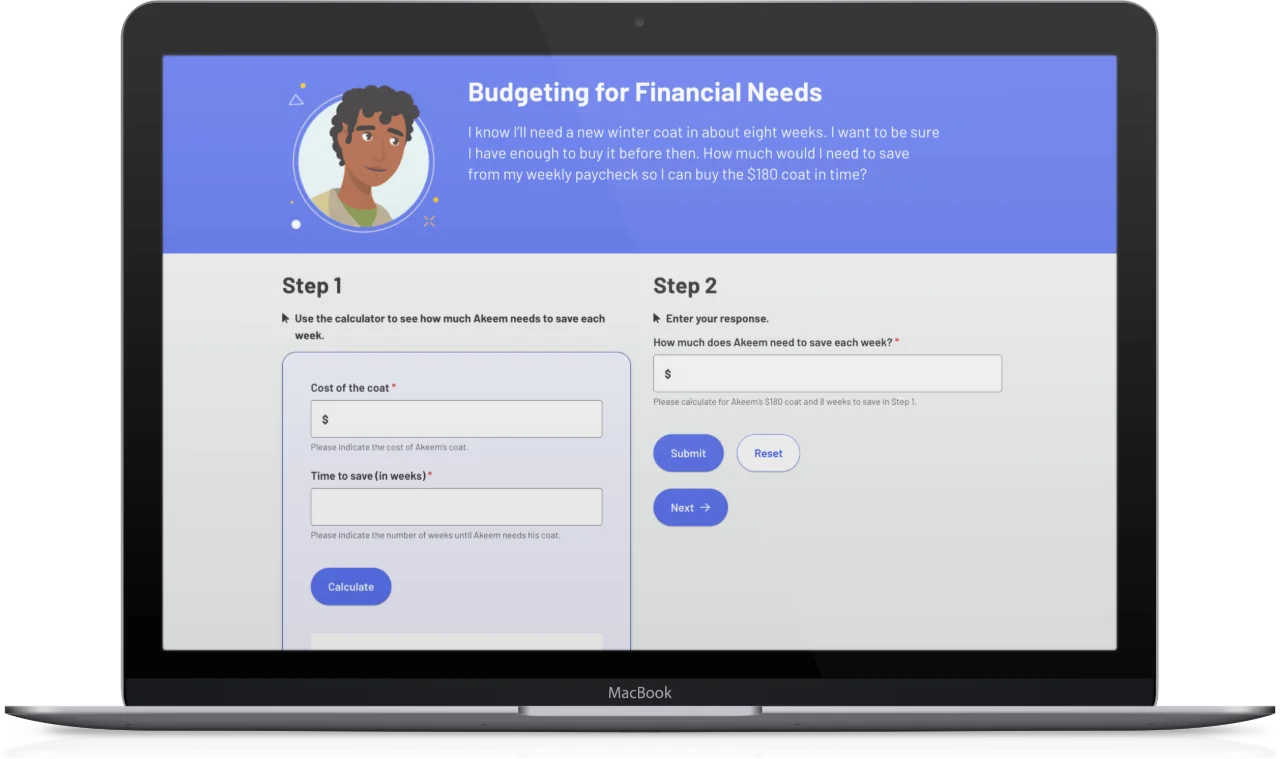

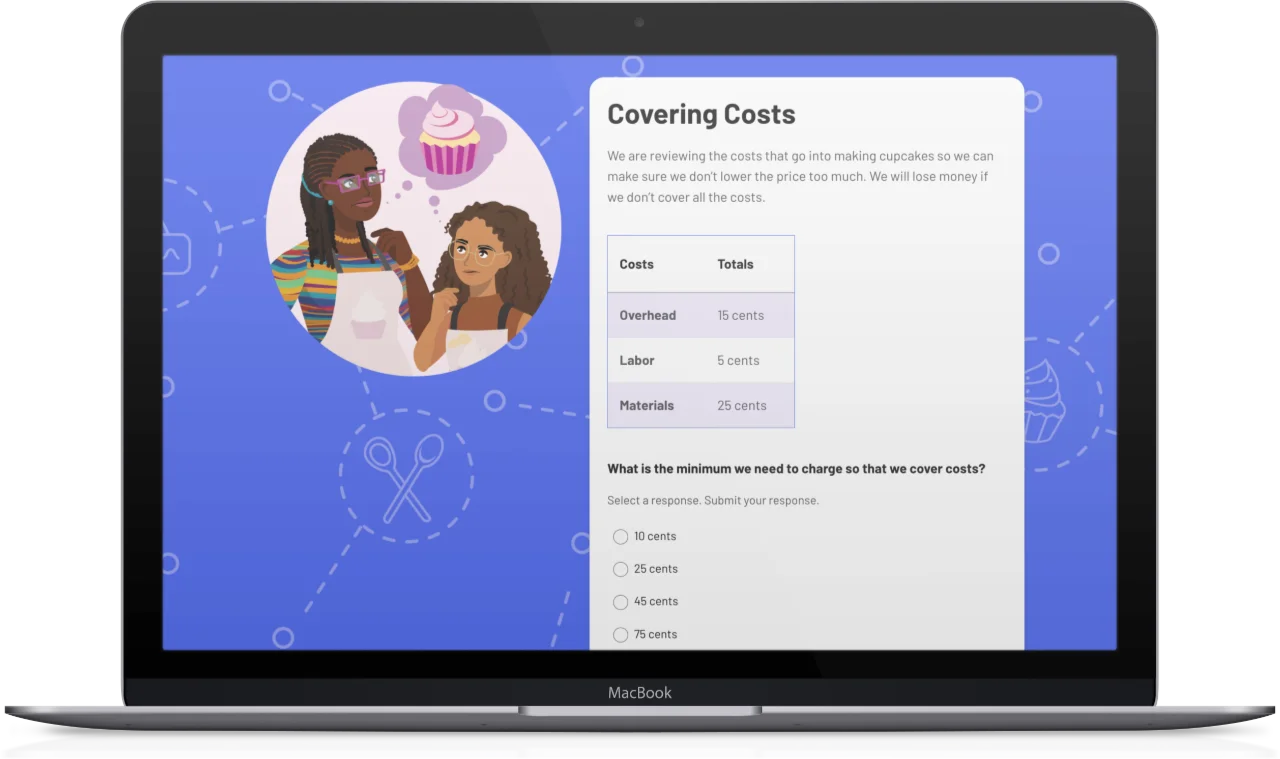

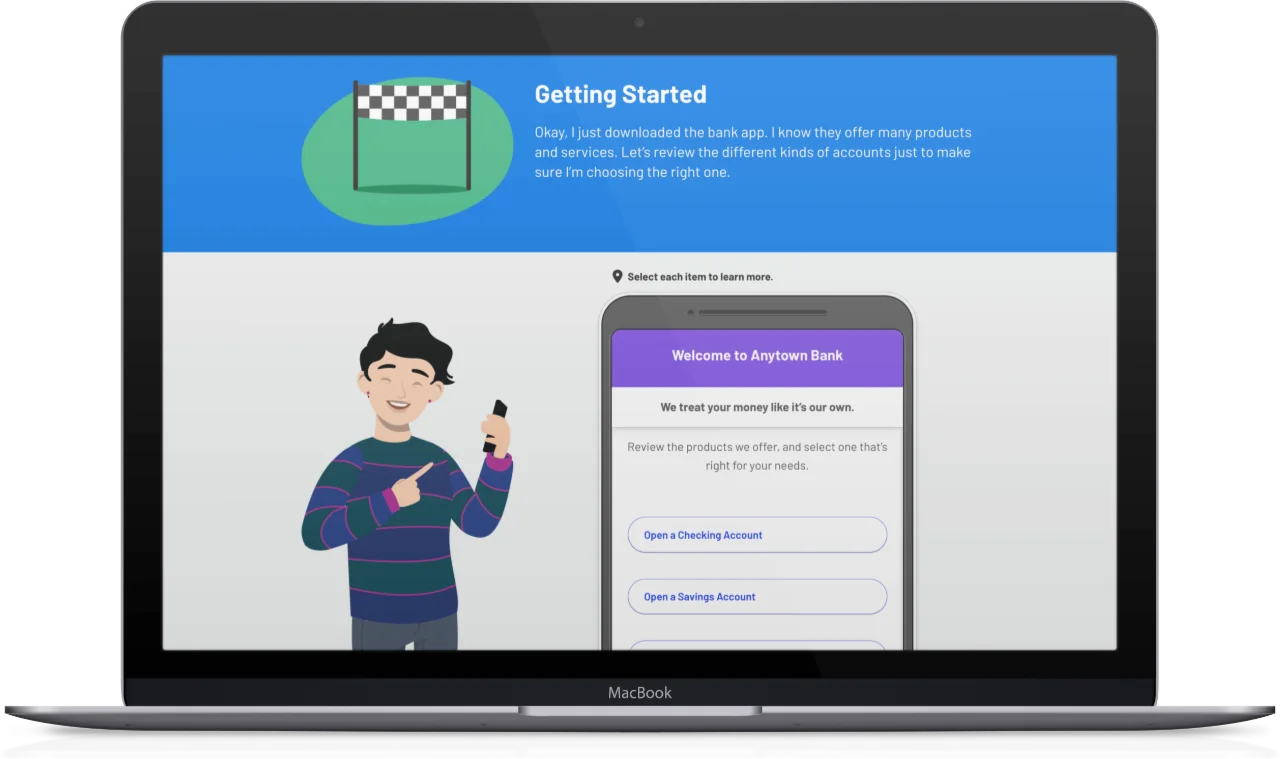

EVERFI's free lesson library offers financial education curriculums for students in grades 4 through 12. Each program offers a range of scenario-based activities, allowing students to puts their saving, spending, and financial planning skills to practice in a real-world context.

Access and Accountability

Asynchronous learning allows for lessons anytime, anywhere with built-in assessments and real-time grading.

Turnkey Lessons

Gamified financial skills in a fail-safe environment. Teachers receive lesson plans, activities, & discussion guides, too.

Implementation Support

Our regional support team guides teachers every step of the way, through on-demand training and professional learning events.

EVERFI'S HIGH SCHOOL FINANCIAL WELLNESS SUITE

Financial Literacy for High School Students

EVERFI’s High School Financial Wellness Suite offers educators the platform to create a comprehensive, customized learning experience, deepening student knowledge around a range of personal finance topics. All of the interactive, online resources are available to schools free of charge.