Why Financial Institutions Should Not Ignore the Benefits of CSR in Banking

In today’s consumer-driven world, where consumer trust is everything, CSR, or Corporate Social Responsibility, is a significant benefit for financial organizations. For the more than 13,000 financial institutions in the United States that have adopted CSR, CSR in banking is good business. A bank’s corporate social responsibility program allows your financial institution to utilize its strengths to benefit the local community. Spreading CSR efforts out across departments, allowing each to contribute to social responsibility in their own way, minimizes investment while maximizing results so that both you and the community benefit.

This, in turn, drives measurable impact across departments as you invest in community efforts, in financial literacy, in more diversity of accessibility and offerings, and indirectly investing in the environment. The benefits of corporate social responsibility for banks go beyond proving your brand is a do-gooder or looking to offset consumer mistrust. Good CSR actively works to improve your community and consumers’ ability to engage in meaningful ways with your organization.

5 Reasons CSR in Banking Can Not Be Ignored

1. CSR Builds Consumer Trust with Financial Institutions

Modern consumers are both savvy and skeptical, which makes them quick to doubt, mistrust, and leave a brand. A Harris poll suggests that 84% of millennials don’t trust the companies they do business with, with Generation Z scoring even lower. At the same time, consumer trust is important for building long-term relationships, reducing customer churn, and even being able to offer personalized service and solutions that work to build those relationships.

CSR in banking is one way to help build that trust, not through grandiose and faraway investments into charities, but through local, targeted approaches. This can mean offering financial literacy programs to local schools, creating outreach and financial aid for the elderly in senior and care homes, and offering public education days so that individuals can come in for free financial advice. It also means actively taking part in individual communities, directing CSR funds at local events, cleanup efforts, and environmental efforts. Why?

Going local means keeping your efforts visible for your community, who are still the most likely to do business with your bank. If you can build trust through CSR efforts not related to making a sale but rather to improve your community, you’ve already taken one of the biggest steps to secure long-term customers and increasing the benefits of corporate social responsibility for your bank.

2. Corporate Social Responsibility Provides Positive Customer Outreach

Customer outreach means actively participating in community and events, which can drive a great deal of publicity and media attention for your business. Providing CSR programs such as a digital learning portal for K-12 students can drive a great deal of brand awareness to the children involved, their parents, and to local news and media outlets.

Positive social engagement actively improves an organization’s public image, changing how people perceive that organization. For example, companies that donate to local food banks are perceived as more philanthropic than those that do nothing. This, in turn, will make consumers feel better about patronizing your organization. Efforts ranging from education to assistance to volunteerism to donations can help you drive this type of positive customer perception.

At the same time, CSR actively works to garner media attention, with investments in the local community playing into positive news stories, shares across social media, and mentions on websites including organizations and partners benefiting from efforts.

Creating a Truly Personalized Digital Experience in Financial Services

Consumers expect seamless digital experiences everywhere—including with their bank or credit union. Are you keeping up with these digital demands?

3. Consumers Actively Appreciate Corporate Social Responsibility Initiatives

Double the Donations reports that consumers actively respond to organizations engaging in CSR. Here, their data shows that 55% of consumers are willing to pay more for products from socially responsible companies, while further driving engagement and public interaction.

Individuals often feel much better about patronizing organizations where they feel their money is being well spent, where they feel that owners and decision-makers actively care about them and their community, and where they can see money actively going back into the community. This will reflect in how consumers choose your products, how loyal they remain to your organization, and in recommendations and public support for your organization.

4. A Positive Boost to Employee Productivity and Engagement

While CSR in banking offers a great deal in terms of outward boosts to marketing, consumer engagement, and consumer trust, it also builds internal trust, employee relationships, and boosts creativity. While not everyone is invested in social good or social responsibility, many are part of their communities and appreciate and respect CSR programs as much as potential consumers. This will work to create a more positive workplace, build employee trust, and reduce turnover inside the organization.

In one study it was shown that employees at socially responsible companies are engaged with their work up to 60% more than those showing no social responsibility. This can pay off a great deal over time, especially as it reflects on customer service and support, creativity, and engagement, and in long-term service to the organization.

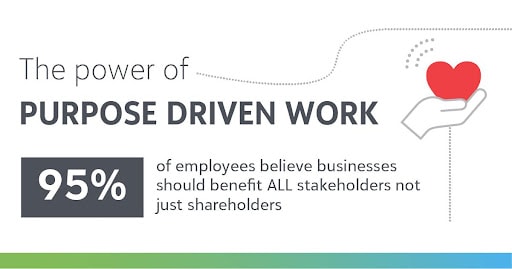

Checkout this infographic on the Power of Purpose Driven Work for even more data on how CSR can increase employee engagement.

5. Community CSR Programs Drive Real Value

While the most obvious benefits of CSR programs are directed inward in terms of improved customer perception and public image, improved media coverage, and more brand awareness, there are many other benefits to investing in your community.

For example, investing in financial literacy for your community will mean that your community is better prepared to make good financial decisions. They’ll have more tools to manage debt, invest savings, and purchase homes using smart loans and mortgages. This means that they have the tools to better use their income in ways that improve their finances, improve profits, and therefore improve both for their banking organizations. Empowering your community to make good decisions actually pays off in the long-run, as they are in better situations to take out mortgages, invest, start businesses, pay off loans, and otherwise contribute to positive economic growth.

How Corporate Social Responsibility Pays Off

The importance of corporate social responsibility in banks will continue to grow. Modern consumers research their banks, learn their spending habits, learn how they use money, and often look at community and consumer opinions before ever contacting that organization. Investing in a social responsibility program inside your community (and outside it if your bank is large enough) will help you to create a positive impact, which will benefit your potential customers as well as your organization’s growth.

The Approachability Gap: How to Connect with Untapped Consumers

50% of consumers hesitate to approach their financial institution for products and services. Learn how financial education can help bridge the gap.

CSR Banking FAQs

What is CSR for Financial Institutions?

Corporate Social Responsibility (CSR) is a type of self-regulation that organizations across various industries undertake to hold themselves accountable for their corporate actions and make a positive impact on society. In today’s consumer-driven world, where consumer trust is paramount, CSR is a significant benefit for financial organizations because it helps to build trust and strengthen the reputation of the organization with its stakeholders, including customers, employees, investors, and regulators. This is especially important in the financial industry where trust and reputation are crucial for maintaining long-term relationships and attracting new business.