Bank Marketing Insights for Financial Institutions

Bank marketing strategies must evolve at the pace of change in order for banks to stay relevant. Working with over 600 of the largest financial institutions in the world gives EVERFI a first-hand look at what’s working and what isn’t.

Bank marketing strategies are rapidly changing. The impact of Fintech alone could result in a 5% revenue loss for banks. So, what can financial institutions do to adjust their strategy for a more digital world? Dig into the compilation of findings and insights we’ve gathered from partnering with successful banks of all asset sizes. We touch on:

-

How Financial Marketing Strategies Are Evolving

-

The Rise of Digital Marketing for Banks

-

Why Financial Content Marketing Is Critical for Customer Loyalty

-

Why Financial Education Is the Key to Growing Assets

-

The Benefits of Financial Education in Bank Marketing

-

How to Combat the Challenges of Bank Marketing

How Financial Marketing Strategies Are Evolving

Which new marketing opportunities could be actual game-changers, and which are just passing trends? In order to prioritize your bank marketing efforts, knowing the difference between the two is critical. That’s why it’s important to stay on top of financial marketing trends that are actually working.

Below is a snapshot of the developing bank marketing trends that you’ll definitely want to pay attention to. This is what your competitors will be offering soon if they aren’t already. If you don’t put a plan of action into place, you could find yourself playing catch up.

Some of the most important trends in financial marketing are:

- Digitization

- Personalization

- Content Marketing

- Data use

- Chatbots

The Rise of Digital Marketing in the Banking Sector

Traditional marketing is falling to the wayside, as banks are digitizing to reach customers that are virtually always online. As physical banking declines, digital sales could account for as much as 40% of new bank revenue within the next few years.

In Western Europe, banks already report half of new revenue from digital sales. The USA is trailing these numbers, but not by far.

Financial institutions have just a few years to:

- Enter into and capitalize on growing digital marketing trends for banks

- Create a financial digital marketing strategy to develop a strong brand presence and drive ROI

While the links in the list above provide much more detailed information, digital marketing for banks encompasses your:

- Website

- Online banking apps

- Online banking experience

- Online advertising (through SEM or Social Media)

- Online communication (chatbots, email, and SMS marketing)

- Digital media and content (everything from YouTube videos to Facebook Posts)

In short, banks have limited time to create a digital marketing strategy that is crucial to developing a brand presence in financial services.

The Ultimate Guide to Financial Marketing

The best financial institutions are winning on consumer loyalty and standing out in a sea of financial providers.

Financial Content Marketing is Critical to Customer Loyalty

Financial content marketing can create an invaluable asset: trust.

If you provide useful information that helps people feel more in control of their financial future, acquiring new customers and growing existing accounts becomes much easier.

And while many banks already do content marketing—they might publish to a blog, have a presence on the big social media platforms, and even put out a video here and there—what’s often missing is a cohesive content strategy with direction to make sure they’re producing the right content, reaching the right audience, at the right time.

The different parts of your content marketing strategy—and your bank marketing strategy as a whole—should not operate in a silo. Everything, from your bank’s social media marketing tactics (paid and organic) to the content on your website, should be connected. Everyone on the team should understand the part they play and where their part fits into the bank’s marketing strategy as a whole.

If you are trying to reach a new generation of customers, there’s even more reason to focus on content marketing. Millennials and Generation Z often prefer self-service and online services to in-person, and many much prefer to use a knowledge base to solve their own problems rather than contacting customer support.

Financial Education as a Bank Marketing Strategy

The vast majority of financial services marketers report that digital financial education is part of their marketing strategy today.

Bank marketing budgets also reflect the role of financial education in the marketing toolkit; more than half of marketers report that their institution has a dedicated budget for financial education.

“We could have tried to develop a financial education solution ourselves, but EVERFI lives and breathes this stuff, so letting them take care of the content let us focus on our customer’s core needs.”

Bill Bunn – Executive Vice President of Retail Banking, First Bank

Real-World Financial Literacy Program

Learn what Kitsap Credit Union’s schools-based financial literacy program looks like in practice.

The Benefits of Adding Financial Education to Your Bank Marketing Strategy

Marketers are enthusiastic about the benefits of financial education in the marketing mix. Top benefits include:

- Improving consumer financial capability

- Bolstering public reputation

- Supporting business opportunities

Bank marketers list improving customer or member knowledge and community relations as by far the biggest benefits.

Financial education is also seen as a driver of revenue.

A third of marketers listed upsell opportunities as a top-three benefit of financial education—with new business opportunities among existing customers and members seen as a more likely benefit of financial education than lead generation for new business.

How to Combat the Challenges of Financial Education in Bank Marketing

While bank marketers recognize the importance of including financial education in their marketing strategy, they also recognize the challenges their organizations face when it comes to implementing financial education in their bank marketing strategies.

When asked to identify their top challenges, marketers cited:

- lack of measurable ROI (51%)

- difficulty engaging customers (47%),

- difficulty finding or generating quality content (21%)

- not enough content available to them (10%) and

- unclear value for meeting regulatory requirements like the Community Reinvestment Act (15% of respondents).

- Few marketers (8%) reported that senior executive buy-in is a substantial challenge.

One way bank marketers can combat these challenges is to implement a digital financial education program that provides reporting on the metrics listed above.

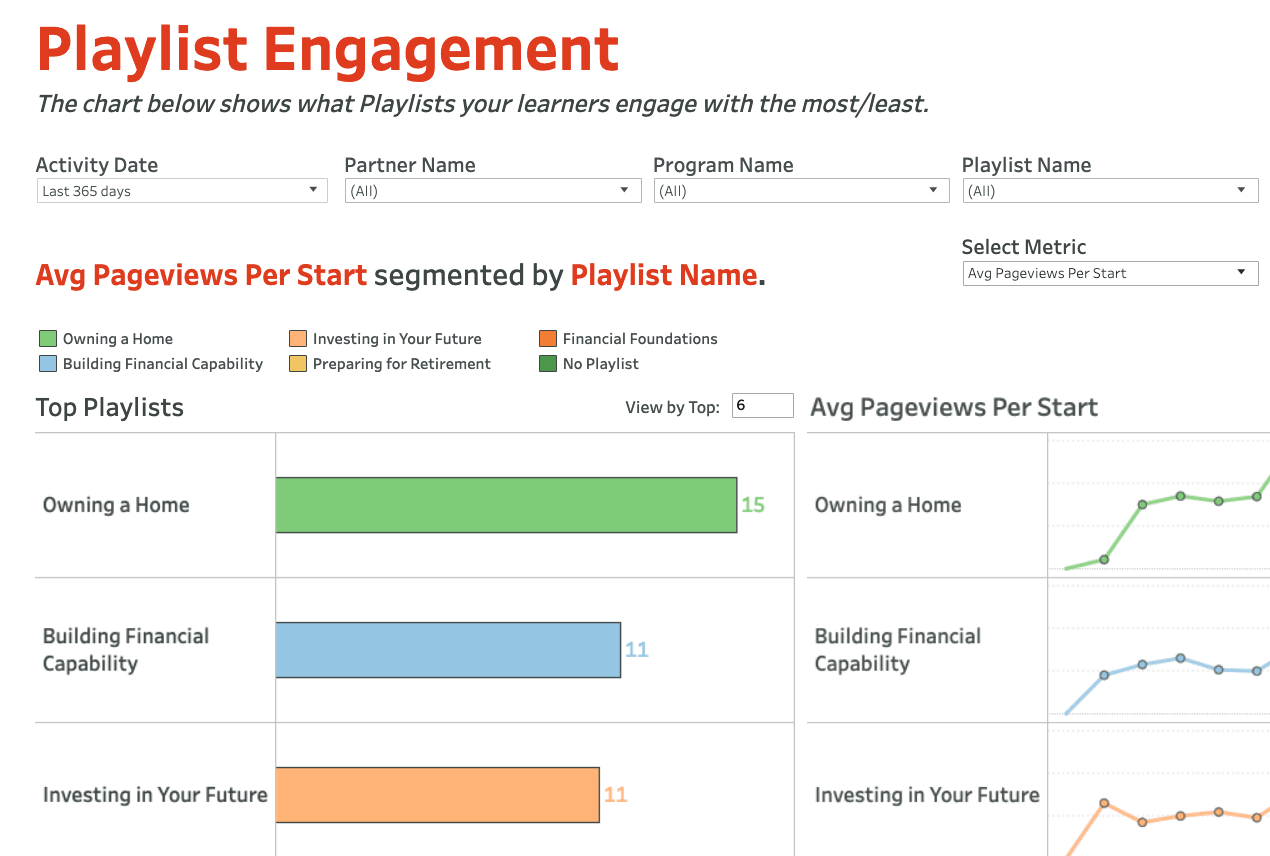

Programs like EVERFI’s Acheive™ provide content from over 60 financial topics. The dashboards also share data like number of users and most popular topics, making it easier to launch a successful financial education program as part of a bank marketing strategy.

How EVERFI Can Support Financial Marketing Efforts

EVERFI is an international technology company that helps financial organizations drive social change by enabling them to offer financial education to their community.

EVERFI can help your financial institution:

- Streamline your approach to CRA compliance with online and in-person K-12 education programs.

- Use digital financial education as a marketing tool with branded, online financial education – right from your website.

- Offer workplace banking to your business partners and deliver increased value to your commercial partners.